8+ Excel Accounting Spreadsheet Templates

At a time when computers were already flourishing, it made sense to come up with an application that provides a good resolve for those who have not acquired professional training in accounting, especially small business owners who are just trying to make a living without the daunting task of manual data entry and record-keeping. Even though at times, you would want something top notch, Microsoft spreadsheet samples is still helpful in terms of accuracy of records and real-time reflection of transactions on your end and the customer’s end.

Using Excel for keeping track of business finances is easy enough to follow. In other software or applications used for accounting, the transaction records go through a trial and error run. In the midst of these runs though, you find yourself trusting the tool so much so, that you think every data reflecting is always solid and accurate.

Accounting Spreadsheet Template

Accounting Spreadsheet Template For Small Business

Accounting Worksheet

Excel Basics for Account Reconciliation

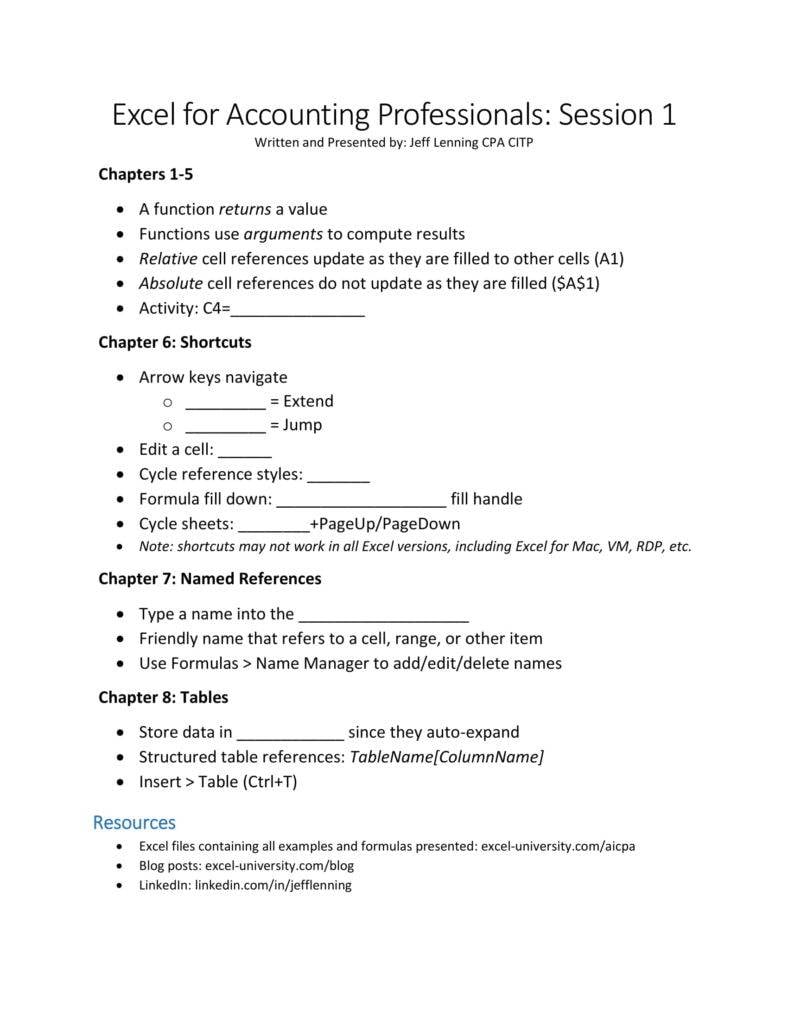

Excel for Accounting Professionals

Introduction to the Excel Spreadsheet

Business owners would always have a dilemma over what to get or have for them to be successful. With so many businessmen in various industries, it can become really challenging to compete or just simply get your finances managed well. You may not realize this, but every dollar in business counts. All the skills to be had cannot be accomplished on a single seating if you want to be good at keeping track of your money going out and money that comes in from sources of funds. Many businessmen, especially the ones that are just starting and aiming to make their business grow, have realized that using technology can help ease the burden of keeping an accurate and organized financial record. These days, doing everything the traditional way is really out of the question.

Spreadsheets

Before the advent of electronic spreadsheets, companies used mainframe computers in processing bulk data. Many organizations at the time weren’t able to justify the funds needed for having small desktop applications. Accountants made journal entries the old school way, using pads adding machines to account for the data on their printed mainframes. The first digital spreadsheets such as Visicalc and Lotus 1-2-3 was such a massive breakthrough in business since they were flexible, fast, and economical. The modern-day Microsoft Excel program maintains the same productivity advantages in the earlier, original programs.

In business, Excel has been commonly used for financially-related tasks and it is living up to its popularity, as it provides the user the ability to define unique formulas for the calculation of annual or quarterly budget reports. As a spreadsheet software, it also helps individuals who aren’t trained in bookkeeping as well as professionals to be more efficient and vigilant in keeping track of profit, customer leads, status reports, invoice, and other financial reports. Another reason for its popularity among professionals is that it provides them an easier way of working through statistical formulas and graphing of important numbers and figures to be able to present an accurate, reliable, and appealing data.

Background

Over 36 years since its development, Microsoft Excel has been leading record-keeping tasks, including accounting, making it easier and simple enough to keep up with, for small to middle sized business owners, and for good reason. Its user-friendly features are a perfect fit for those who aren’t accounting professionals or those who have no general idea of bookkeeping altogether. Its famed usefulness really comes as no surprise at all, as it maintains to keep hold of a good part of the accounting market for small businesses even though the availability of more advanced and sophisticated accounting tools.

Common Mistakes in Entering Data

No matter how you keep a close monitoring of your financial records, there is bound to be a slip-up happening sooner than later. Mulling over inevitable mishaps will not do any good. You see, people often underestimate the frustrations that can be caused by neglecting a simple task like closing the file, using the right formula, or having a big mess you call records, lost among all the other files, past and present. What a field day that would be if you have to go looking for it again. Try not to get your list of items jumbled, for starters.

- Invoices and Deposits

People make incorrect application of deposits into invoices. The thing is, you do not realize it until you go through your accounts receivable report and you see balances for customers that confuse you because they should not be there. Take note that whenever a customer pays, automatically, the payment should be reflected in an open invoice and not otherwise.

- Mixed Up Items List

Products you sell are tagged as “items”. As years go by, some businessmen make the mistake of rendering old records or archives useless, throwing them away, without updating the amounts. Try cleaning up your list in a more organized way. Label them based on the ones you sell and no longer sell. Learn how to classify so that your files would not be confusing no matter when you open it next. For the ones that you still sell, keep the cost updated regularly. Get rid of the list of items you are no longer selling and make sure that you really label them accordingly.

Benefits of Using Excel Spreadsheet for Accounting

- Easy Payment Monitoring

Although people and individuals who are new to accounting, as well as business owners who are short on bookkeepers may find it hard to keep track of payments and money that comes in, spreadsheets provide them a simple solution. This is because spreadsheets are widely used to check money being spent and income received. By using spreadsheets you can sort data based on the amount of money spent and received by a certain period and where it came from. For example, you can split insurance, rent, supplies, and monitor how much you can allow your business to spend on this every month by making use of a simple table. Incorporating these spreadsheets will help a lot in your everyday activities for any accounting task you have applied or signed up for.

- Incorporating Data

One of the benefits of using spreadsheets is that you will be able to link worksheets together for a more reliable and easy to understand cash flow, where you need to record the actual balance from at the end of last month to this month’s opening balance. Just hit this sign “=” in the cell where you want to link it from and position the cursor in the cell you want to link it to. This is also very helpful for setting budgets, especially if you were able to create a completed budget in one worksheet, incorporating it into the main budget. In the event of production budget changes, the main budget is then automatically updated.

- Useful Formatting

Working with, and always looking at too much data in front of you, it’s only fair to make it as easy to navigate and go through, as much as possible. Fortunately, there are many spreadsheet software offering different features to make your spreadsheets presentable, appealing and comprehensive. In selecting a cell, you can use “Ctrl + B” to make the texts in that cell bold which would be good for making labels and titles of your data stand out. Better yet, you can also choose to have the cells color coded so that you can sort data by color, which would make the task a little less daunting.

- Editing

Creating a spreadsheet means entering data into a worksheet. Every item in that data is then stored within a cell. These cells can also include formulas you have written or those picked from a predetermined data set that are meant for common tasks. In some cases, a spreadsheet has cells that calculates based on values found on other cells. When you update these values in other cells, the calculation result in the formula cell, will, in turn, gets updated. Because of this, it is better to perform a regular calculation, tracking and analyses on data set automatically. Spreadsheets offer you that, on top of everything else.

- Formulas

You can only appreciate spreadsheets if you know how to take advantage of its usefulness by knowing how to use its ability to enter mathematical formulas to your advantage. For example, this formula gives out a calculation on a numerical item: =B9*2. The value of B9 will be multiplied by two within the cell, because formulas can carry out different processes on sets of data, such as testing whether values met certain conditions, checking values within a certain range and expressing mathematical operations, calculating and transforming data among others.

- Productivity

Excel spreadsheets increase productivity by the reduction of labor in a business’ everyday accounting tasks that need to be finished, which would be otherwise nearly impossible if you lack accounting professionals to perform them. As you enter data in the spreadsheet one by one, formulas calculate and gives multiple results and sums at the same time, in a real-time manner. This means you are saved from having to manually add up totals by certain data sets since the spreadsheets already do this task for you. More time is saved, more tasks are performed in an office, resulting in an increased productivity rate.

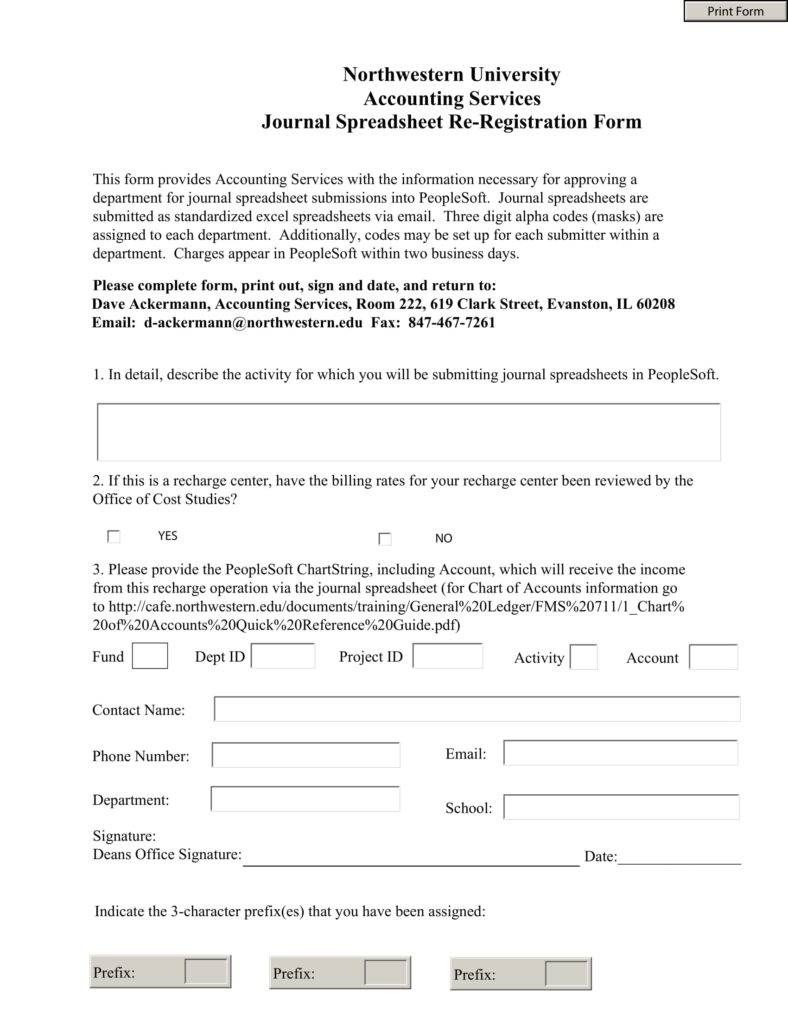

Journal Spreadsheet Registration

MS Excel for Accounting Professionals

Spreadsheets in Financial Departments

You don’t need to have an accounting degree to keep your finances intact in business. But a working knowledge of Excel is very important for most people who have the typical office-based, desk jobs. Excel may just be a part of an operating system’s application, but it is a powerful tool that takes a computer savvy user to get the best out of and maximize the advantages it can offer.