20+ Work Questionnaire Templates in PDF | DOC

Work Questionnaire is a general form of a questionnaire that contains a list of questions that are related to the…

Jul 23, 2020

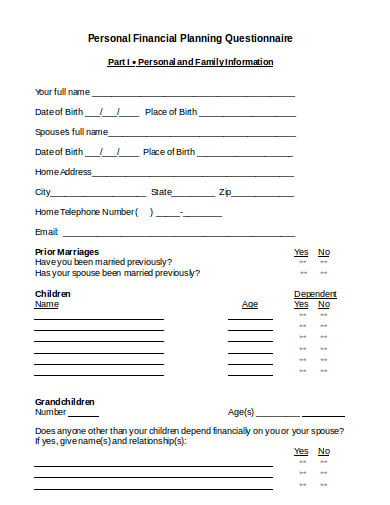

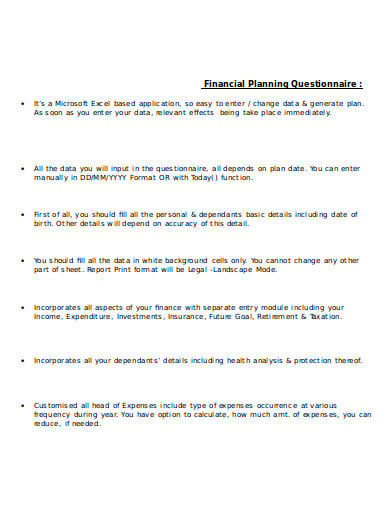

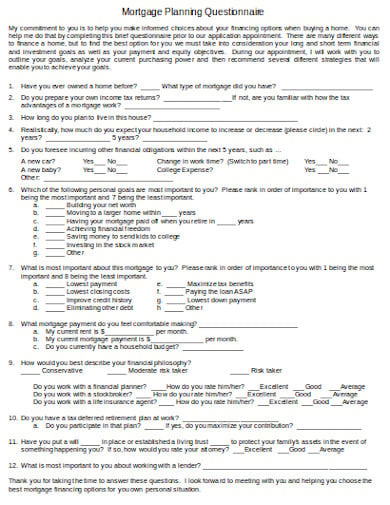

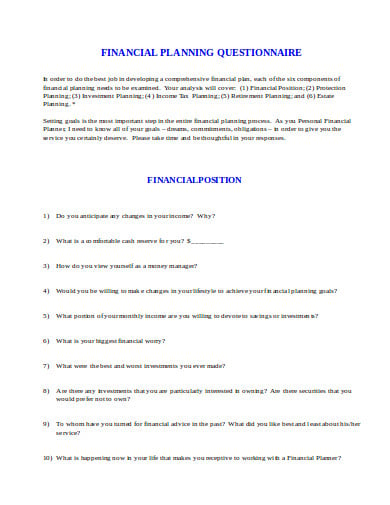

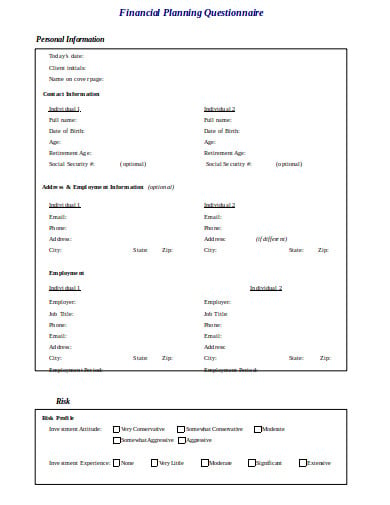

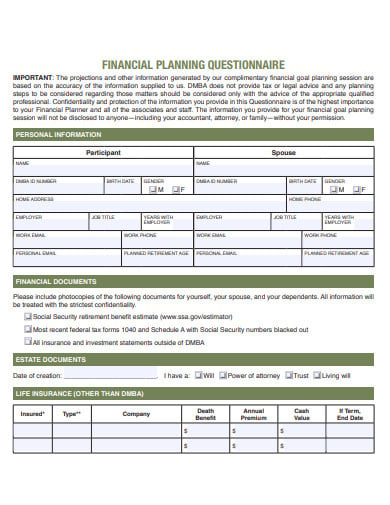

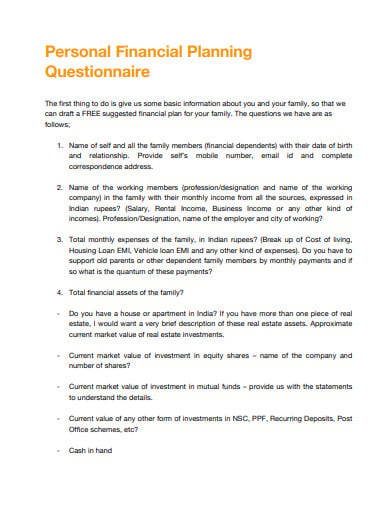

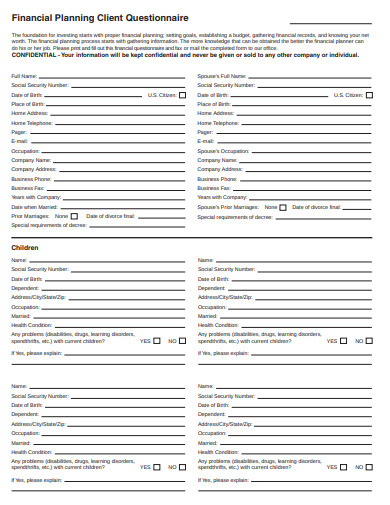

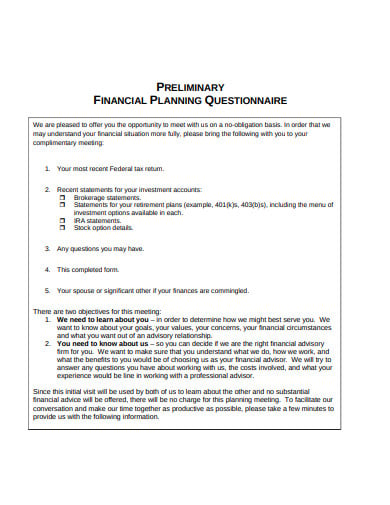

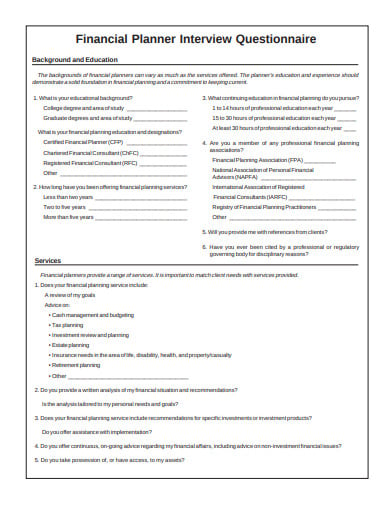

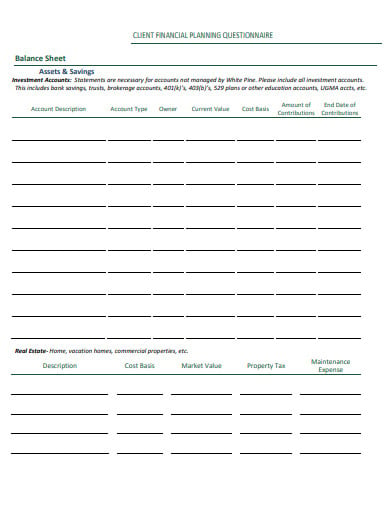

The financial planning questionnaire consists of a list of questions which is utilized for the method of assessing the capital needed and preparing its competition. It is the means of mounting financial policies in relation to procurement, investment, and administration of funds of an industry. Have a look at the financial planning questionnaire templates provided down below and choose the one that best fits your purpose.

cfany.com

cfany.com freefincal.com

freefincal.com mortgagecoach.com

mortgagecoach.com deciliofinancial.com

deciliofinancial.com yeyni.com

yeyni.com dmba.com

dmba.com simplus.co.in

simplus.co.in opulencefinancial.com

opulencefinancial.com pacificcrestfa.com

pacificcrestfa.com aaii.com

aaii.com wpinv.com

wpinv.comThe goals and objectives of a financial planning questionnaire are as follows:

The initial and most significant step to creating a financial plan is to produce a budget listing where your money goes now.

Be practical in setting out your goals, and be precise. You want to attain success, not fail, and you can do that only if you commence out with achievable, particular goals. Be genuine in setting out your goals, and be distinct.

If you do have a family, you will want some limitation coverage and lots of life insurance to guard your loved ones. No matter your financial situation, insuring against the unforeseen can help keep you on the right path should accidents create a financial burden.

You can’t get anyplace these days without good credit. Make sure that there are no inconsistencies between your records and the credit reports. If there are faults, you need to contradict them with the agency that is reporting them. Instructions on how to contradict mistakes are added at the agencies’ websites.

The key to any savings plan is not income but outgo. Even if you earn a high wage, you’ll be able to outspend your financial gain, various individuals do. But if you control your outgo, on the other hand, it doesn’t matter how much you bring home, because it will be more than enough. You’ll want to put this money aside and attach it to it until you have at least three months’ worth of income in a money market or savings account.

After preserving enough for an emergency fund, you should start to look toward investing extra money. For new and seasoned investors similar, the most easygoing way to begin building a portfolio is with mutual funds.

Maintain your financial plan, in part with a yearly checkup to guarantee that it stays harmonious with your personal circumstances. Depending on conditions, it may make a judgment to review your plan semi-annually, even quarterly.

Plan an exit procedure to suit every financial purpose in your plan.

Building a financial plan helps you see the big picture and set long and short-term life goals, a significant step in mapping out your financial future. When you have a financial plan, it’s simpler to make financial decisions and stay on the path to meet your purposes.

Work Questionnaire is a general form of a questionnaire that contains a list of questions that are related to the…

Security Assessment Questionnaire (SAQ) is basically a cloud duty for guiding business method management evaluations among your external and internal…

Before the final employment, a final screening is run to get the basic knowledge of the candidate’s health condition. The…

Survey questions to ask a young person is a questionnaire to know what the child is thinking and to understand…

Who can live without food? Food is one of the basic necessities of an individual but do we realize the…

A pre-employment questionnaire templates is one of the important methods used under the pre-employment assessment. It helps in evaluating job…

A student experience questionnaire form is meant to assemble the essential personal details of every student of the various departments.…

The financial planning questionnaire consists of a list of questions which is utilized for the method of assessing the capital…

Financial management questionnaire pays attention to queries about the ratio, equity, and debts. It means planning, organizing, directing, and controlling…