10+ Employee Stock Purchase Plan Templates in PDF | Word

An employee stock purchase plan (ESPP) is a program the is run by any corporation and that allows participating employees…

Jul 31, 2024

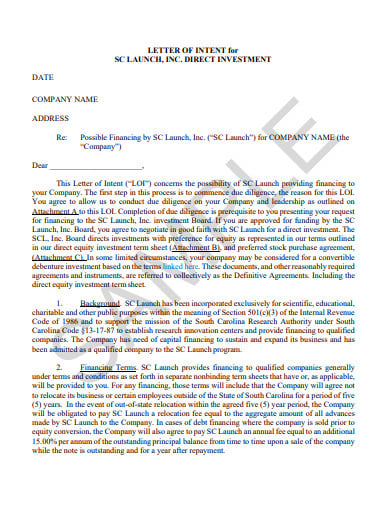

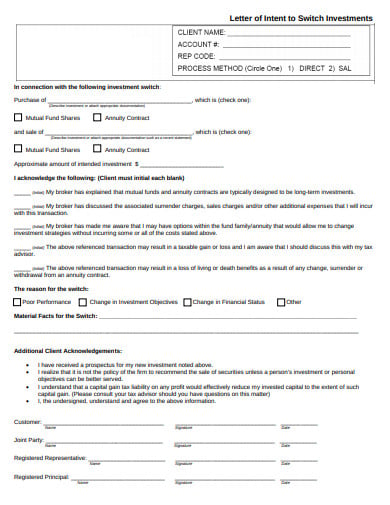

A letter of intent for investment is used between a corporation and an organization and/or person who plans to invest in the company in return for purchasing a set number of shares in the company. The letter sets out the basic investment plans including the amount to be spent, the company to be established and the transaction’s closing date. A written Letter of Intent concerning an investment in a prospective company is necessary. The letter will act as the investor’s formal notice and will prove invaluable in case the parties have disputes about the investor’s intentions.

scra.org

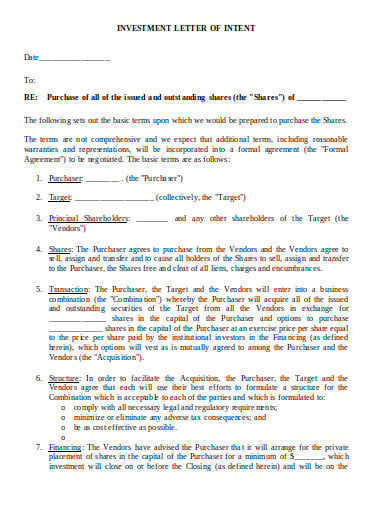

scra.org findlegalforms.com

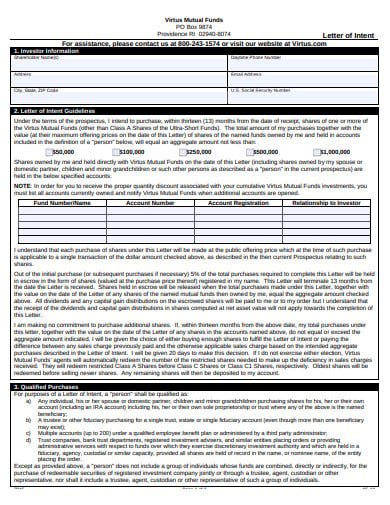

findlegalforms.com virtus.com

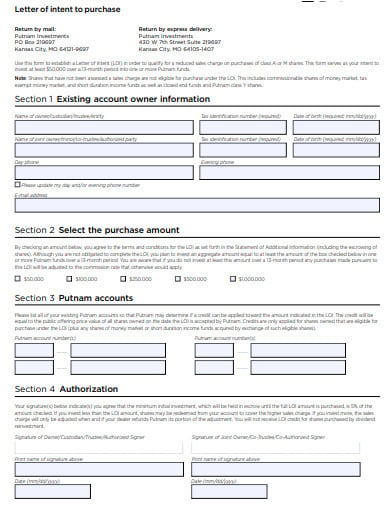

virtus.com putnam.com

putnam.com clevelandheights.com

clevelandheights.com capital-invest.com

capital-invest.comThe first step to make a letter of intent in word for investment is to provide a heading that also defines each party’s mailing address. The investor information must be documented using the blank lines at the top left corner of the page. The address has to be a valid communication form that the Invest may use when contacting the Investor. In this way, type the investment entity’s official name on the first blank line. Use the remaining blank spaces will then require the mailing address of the Investor. This should be a number for the building, street or road name, suite, city, state, zip code. The Investor may also use a post office box address if this is well maintained.

The letter’s first statement must contain the letter’s intent in pages. The terminology here will provide the Invest with some important information but the Investor needs some attention. If this letter is a binding document that obliges its sender to its contents, mark the first checkbox in this paragraph. If the investor sends this letter and does not intend to fulfill any obligations unless at will, mark the non-binding checkbox. Now that we have completed the basic introduction of this letter, it will be time to solidify some facts for both parties’ benefit.

It is important to document what the investor is investing in and use the blank space to describe the investment. Make sure to record how much money the investor will put into the investment by using the blank line labeled as investment Contract. It will be the total amount of money that the investor seeks to surrender to the Invest by the date of closing. The Principal Members are the persons who control the current investment. The full name of each Principal Member will need to be mentioned using the blank space in primary members. You must name the ownership interest the investor will hold and how much money such ownership will cost the investor and record the amount that must be surrendered to the principal members.

In the closing section, you must give the specifics on how or when the closing should occur. You may even continue this report in an attachment in case there is not enough room and make sure to cite the attachment. You may even write the word pending or none depending on the circumstances. This simple letter must cover the circumstances that must be in place for the closing to occur properly.

You must quickly define the status of a potential formal agreement. You can choose one of the check-box statements that are presented and provide the requested definition. You will also have to provide how many days the investor will have before entering such agreements with the principal members. You can also use a formal declaration that the USD will be used to define the amounts of money that are involved with this document.

The investor sending this letter must sign under the space named as investor’s signature along with his/her name. He/she must enter the current calendar date on the blank line that is labeled as to date. Every other investor who wishes to be involved with this letter must sign it. You may also provide an attachment with the remaining signature, or you may use your editing software to simply add the signature. The principal members who are going to receive this letter as invest must agree to it and then sign the principal member(s) area by the calendar date. Make sure to return it by the date you reported. This may only be considered a formal receipt and acknowledgment of this document if each principal member signs and prints his/her name on the principal member’s signature.

A letter of intent in pdf investment is generally a document that has the power to act as a symbol of good faith when intending to invest. It can also act as a legally binding contract that depends on how the document is made. This paperwork gives a wide range of options and conditions to cater to each party’s needs to the investor and the principal member(s). It highlights the following key areas:

An employee stock purchase plan (ESPP) is a program the is run by any corporation and that allows participating employees…

A Share Repurchase Agreement is a contract between a company and at least one of its investors where the organization…

Asset Allocation is a venture on various investment strategies that intends to adjust chance by partitioning resources among significant classifications,…

A written statement of policy on fraud suggests that the battle against fraud is embraced and sponsored at the highest…

A fraud risk assessment is a type of management that is a device utilized by the board to distinguish and…

A certificate of deposit is a certificate issued by a bank to the individual depositing money at a defined rate…

The investment commitment letters are the engagement between two organizations promising to render financial assistance or pay back the debt…

An equity investment term sheet is where the investor puts resources into an organization by buying portions of that organization…

A return on investment report (ROI) is a financial formula that is used to measure the benefit an investor will…