Table of Contents

- Construction Receipt Template Bundle

- Receipt Template Bundle

- 9+ Sample Construction Receipt Templates

- 1. Sample Construction Receipt Template

- 2. Building Construction Receipt

- 3. Construction Cash Receipt Template

- Elements of a Construction Receipt

- 4. Construction Payment Receipt Template

- 5. Sample Construction Receipt Template

- 6. Free Simple Receipt Template

- 7. Free Payment Receipt Template

- 8. Sample Cash Receipt of Construction

- 9. Official Receipt Template

- 10. Free Generic Receipt

- Steps to Design an Excellent Construction Receipt

- Types of Business Receipts

9+ Sample Construction Receipt Templates

Making sure your financial transactions are documented well can only be possible by issuing a cash receipt to your customers after every transaction is made. You keep a copy as the vendor in order to have a record on file for the golds sold which also helps a lot in your accounting. You may also see receipt samples.

Construction Receipt Template Bundle

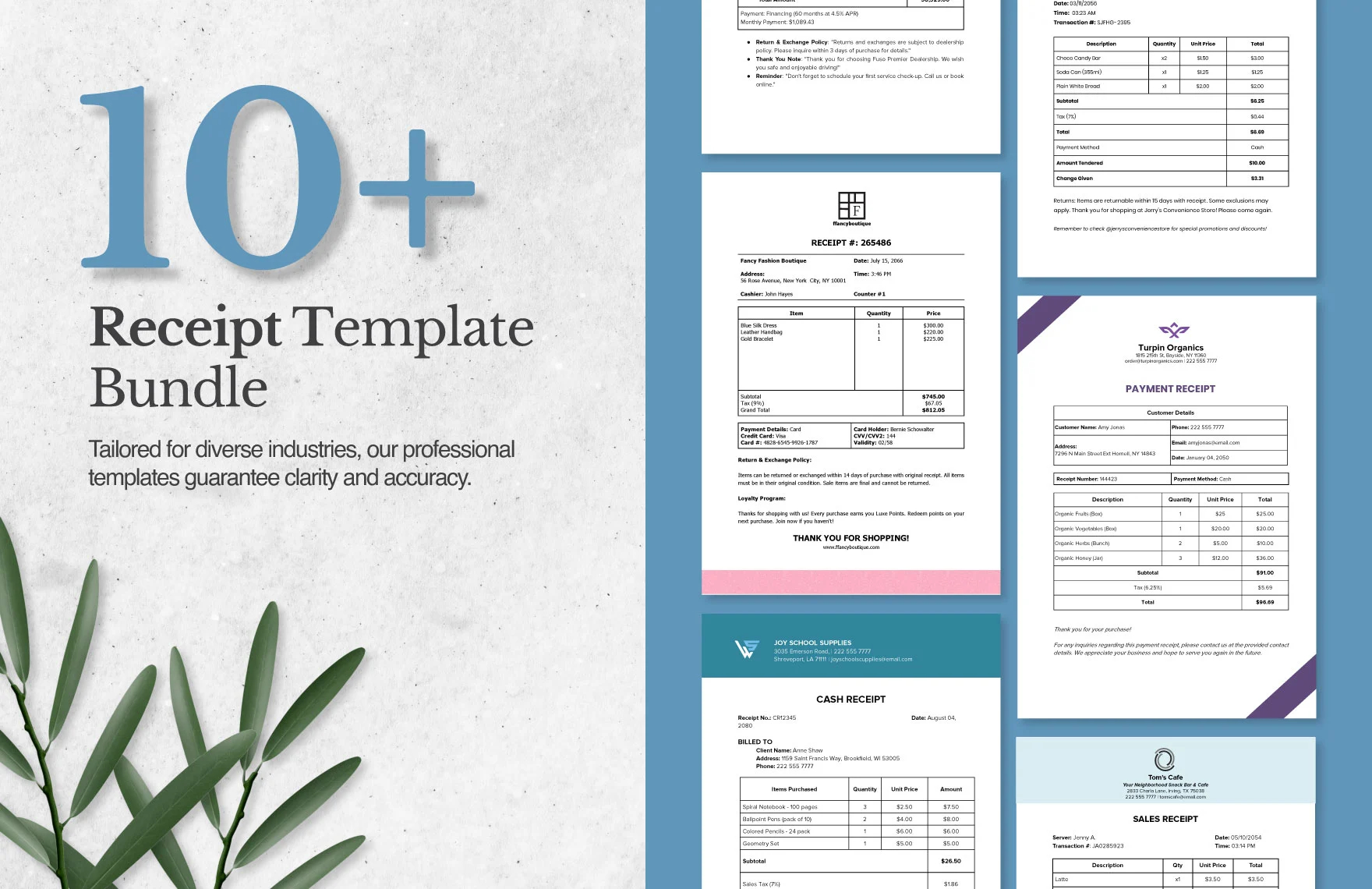

Receipt Template Bundle

9+ Sample Construction Receipt Templates

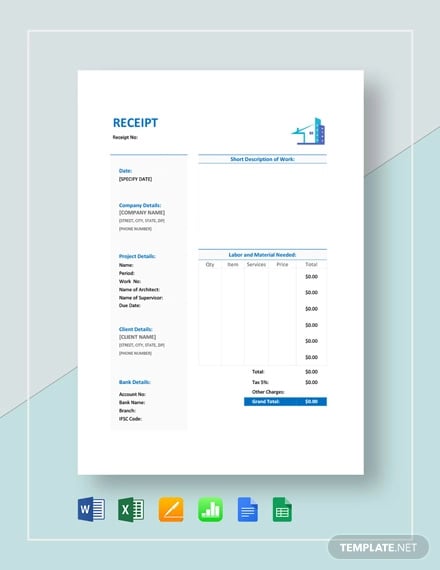

1. Sample Construction Receipt Template

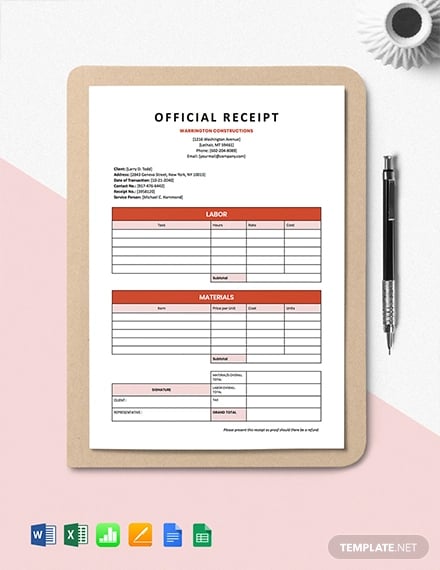

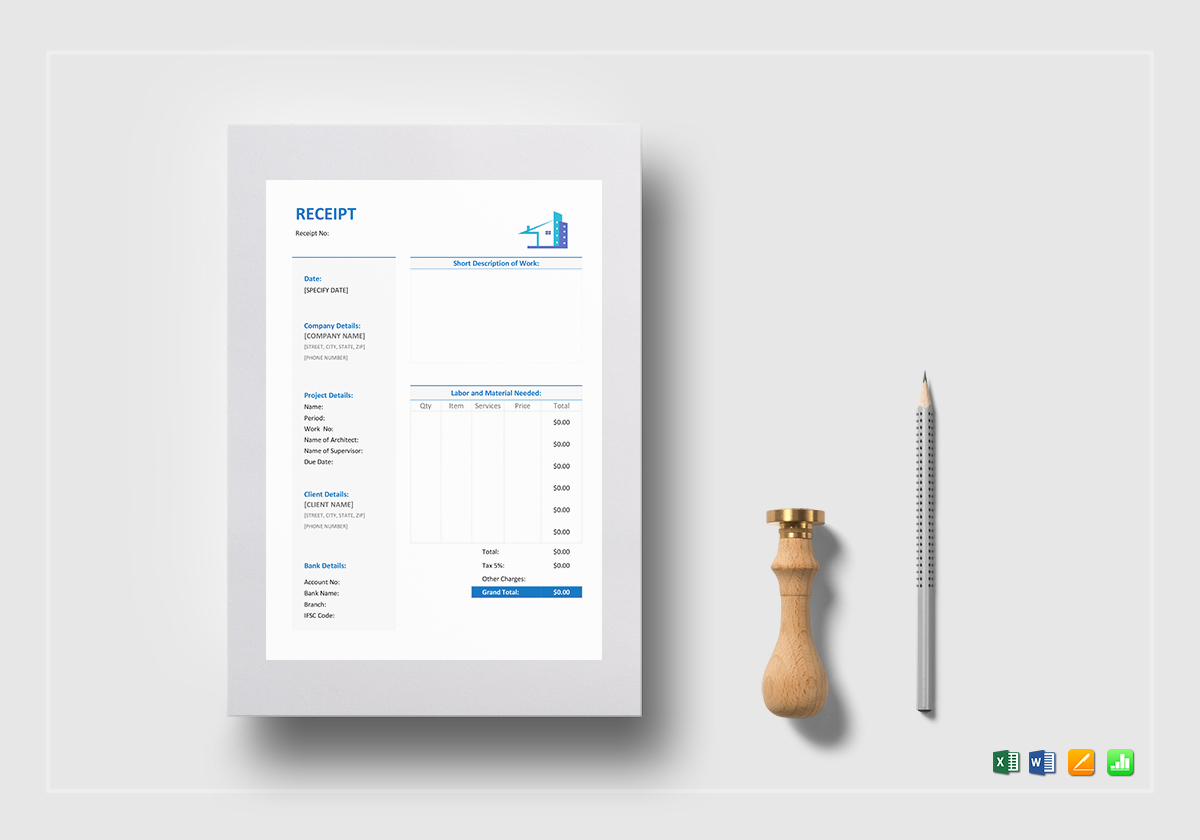

2. Building Construction Receipt

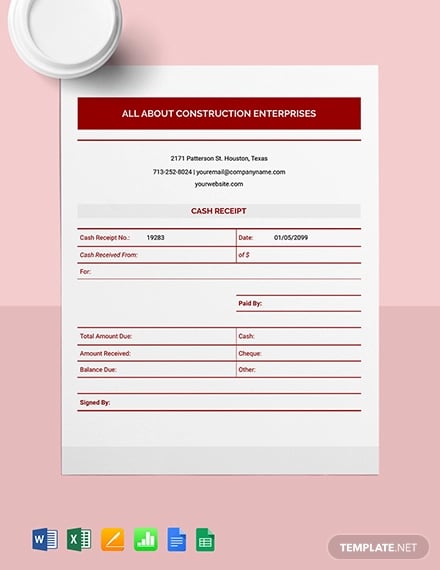

3. Construction Cash Receipt Template

Elements of a Construction Receipt

Receipts are an important part of a businessman’s operations as they let him know how much was sold exactly and what level of inventory he needs to get. In the case of the customers, cash receipts serve as a record for keeping track of purchases. As a vendor, your cash receipts should have the following elements:

1. Business Name and Address: The top of every service and sales receipt should show the business name that issued it, including the address. There are times when you’ll see the name of the store or business at the bottom part of the receipt but it should nevertheless be seen on the receipt. It’s very important to clearly present the business name and address so that the customer know where they can go should they have issues or questions regarding their recent purchase.

2. Price, Services, or Products: There should be a list of items that the customer purchased and the corresponding price beside each of them, which would likely take up a good part of the receipt. This is the most important component in a cash receipt because it allows both vendor and customer to check and refer to what was bought and sold and correct any discrepancies as necessary.

3. Subtotal, Taxes, and Total: The receipt should include a section or category for the subtotal where taxes charged can also be found. Most of the time, this is located under the listed of items purchased and their prices because the subtotal is the sum total of all the products or goods bought before applicable taxes. The taxes section will list the amount of tax being charged on the purchase which is then added with the total of the goods and makes up the total amount the customer has to pay all in all.

4. Transaction Record: Located just below the total should be a section which records how much the customer paid and the change if she received any. This is another important part of the receipt since it can be referenced when the customer was given the wrong amount for the change. This is where you see the transaction or official receipt number which the vendor uses to track the receipt issued in case he needs to.

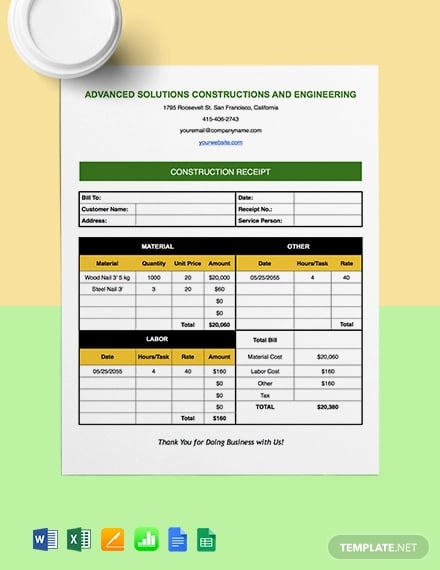

4. Construction Payment Receipt Template

5. Sample Construction Receipt Template

6. Free Simple Receipt Template

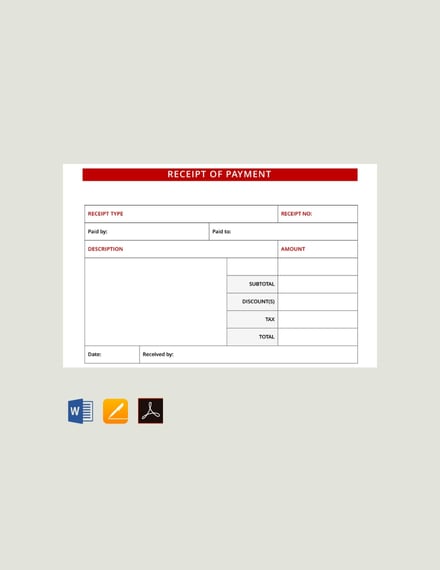

7. Free Payment Receipt Template

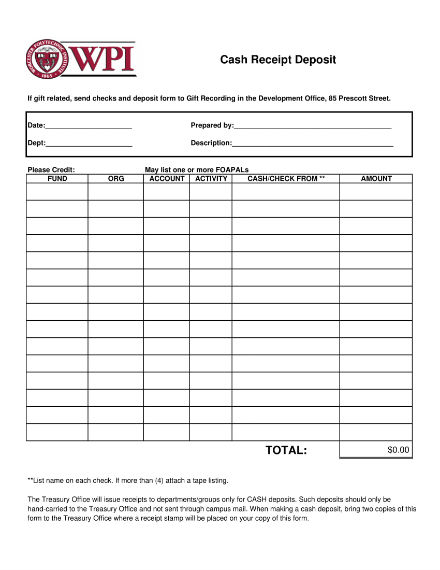

8. Sample Cash Receipt of Construction

web.wpi.edu

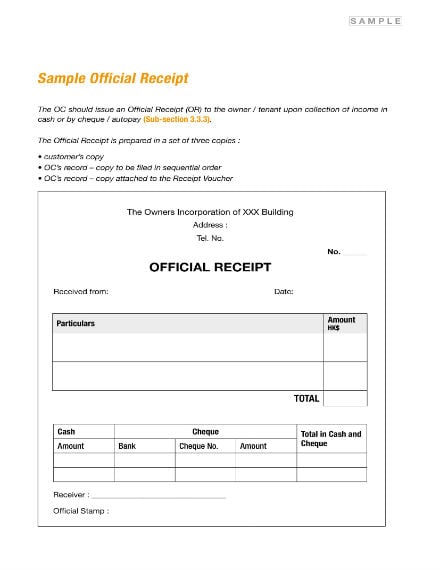

web.wpi.edu9. Official Receipt Template

bm.icac.hk

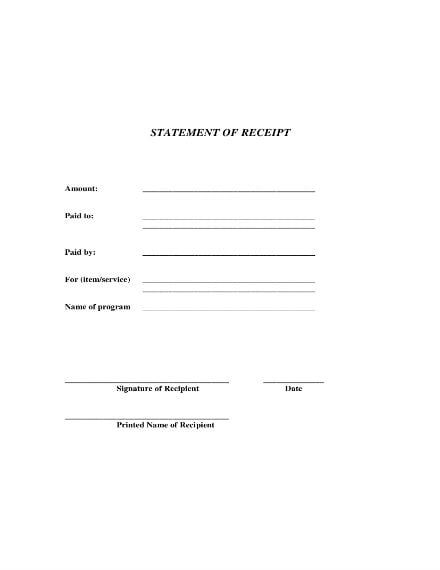

bm.icac.hk10. Free Generic Receipt

cie.columbusstate.edu

cie.columbusstate.eduSteps to Design an Excellent Construction Receipt

A receipt serves as a written documentation and acknowledgment of receiving a specific amount of money for the exchange of goods or in the case of construction, services, and vice versa. When running a construction business or any type of business for that matter, it is always wiser to have a receipt on hand for your records. Follow the steps below if this is your first time creating a receipt for your construction services:

1. Purchase carbon copy receipts for faster transaction: If you prefer your receipts handwritten, set aside an amount for pads of carbon copy receipts so you’ll be able to write one receipt and have two copies at the ready for you and your client. Most of the time, these are also labeled with all the basic and necessary information much like any sales receipt.

2. Write all handwritten receipts with dark pen ink. Your goal is to keep the receipt as a permanent record of your transaction on the site and off it, before and after the project is completed, so use a pen with dark ink to make sure the receipt you have is legible and clear. Also, make sure to write in legible handwriting that would be easy for the average person to read.

3. Use ready-made or blank receipts with your company name. A receipt is a professional document no matter what size it comes in and the only way to make sure you establish that it is official is by having your company name stamped or printed on the top corner of all receipts you issue the client. This will help the client understand and be confident that the services cited will be a useful reference just in case he needs to check back on it in the future for his company’s auditing.

4. Include all necessary information for the sales receipt. Whether you are handwriting the receipt or creating a receipt template in a text document on a computer, your receipt should include several basic sections:

- Vendor details

- Client details

- Date of the transaction

- Services rendered

- The amount of the transaction

- Mode of payment

- Signature from the construction firm and client

Tips In Creating A Construction Receipt

Whether or not the project is as small as a simple kitchen overhaul or a total home improvement job, the construction receipts you issue the client or customer will be vital in making sure every penny spent and received for the service was properly noted. We have gathered these two tips to help you issue receipts better:

- Recognize the purpose of a receipt: One of the most important reasons why receipts should always be a part of your construction business operations is because they help you keep track of the income you have made for the fiscal year when it’s time to file your taxes with the IRS. Save all of them because you would need your receipts later as proof of transactions.

- Consider returns and exchanges: Like most companies, your firm probably offers a money back guarantees for failed or unsatisfactory service in line with your warranty policy. When the customer gets the wrong task done, just like presenting a receipt for a wrong item, he also needs to show the receipt for the job your staff made in the property.

Types of Business Receipts

As an owner of a construction business, you should also be aware of the two most common types of receipts that you most probably would be issuing to clients or customers. Generally, you’re allowed to write a receipt for any transaction such as medical checkups, rent payments to services like yours:

- Cash receipt of payment: For a transaction process to be complete, the one who sells their services of items will draw up or issue a cash receipt of payment. This receipt would include a unique receipt number and the amount received. Payment made in cash should be noted as “cash” and other modes of payment should be noted accordingly.

- Cash sales receipt: This is what you give to customers when they shop for your products or construction supplies or after you have completed the project or services agreed upon on the contract you have both signed. The receipt then acts as a proof of services rendered and should include the amount paid for by the client, the date it was made and the specific service with its corresponding charges indicated as well as the name of the person or the business the service was made out to.

Construction Receipt FAQs

Why does a business need to keep copies of the cash receipt?

For internal accounting purposes, your construction company would need to keep a copy of a receipt issued to clients on file since they are the only documentation which accurately tracks sales and revenue

How helpful is a cash receipt as a record of a transaction?

Receipts are kept so that the company’s bookkeeping or accounting department can reference receipts to service transactions especially for the most recent projects made.

What role does having a receipt play in IRS requirements?

Businesses sometimes have to face audits conducted by the federal state or to be more specific, the Internal Service Revenue on its tax returns. In this case, receipts serve as a valuable record of service and sales transactions and are used for accounting and financial reporting of any existing discount and promotions.

Without receipts, customers might only be able to get a small refund or replacement of some sort when they discover something wrong with the product or part of the task done by a construction contractor. The receipt also conveys important information about the return policy and warranties such as how many days from the date of purchase a customer has to return items or notify your business for negotiating remedies or services rendered.

Proper documentation in business is important as it also defines how organized you are with your business transactions, especially when it comes to monitoring your expenses and what is paid to you by clients and customers.