29+ Free Business Receipt Templates – PDF, Word

No matter what kind of company you’re a part of, you must provide customers with a document which contains all the details regarding a finalized transaction. The reason for this is because both you and the customer stand to benefit from the information regarding what transpired and how the transaction concluded. You may also like sample receipt templates.

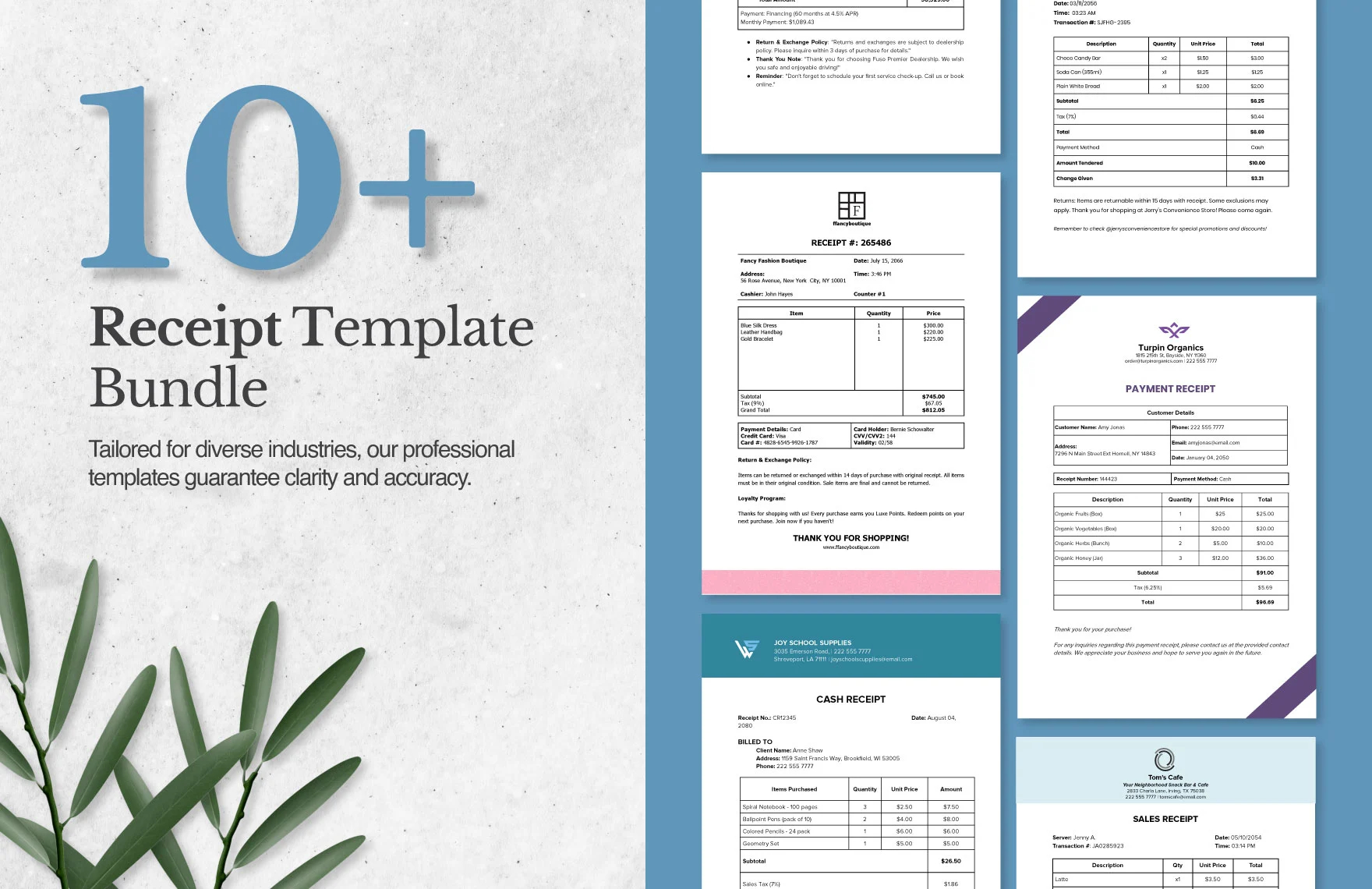

Receipt Template Bundle

Construction Receipt Template Bundle

So what kind of document does one need to make? That would have to be a business receipt and this article is going to teach you everything you need to know regarding the steps you’ll need to take in order to make one and its utter importance in the world of business.

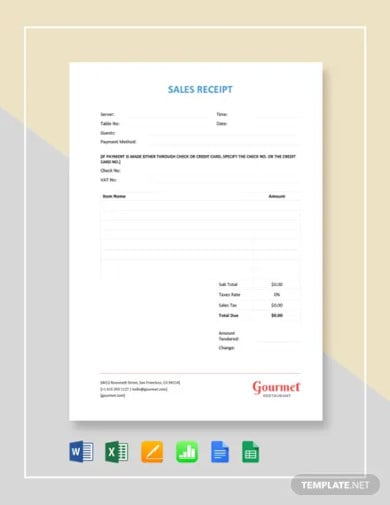

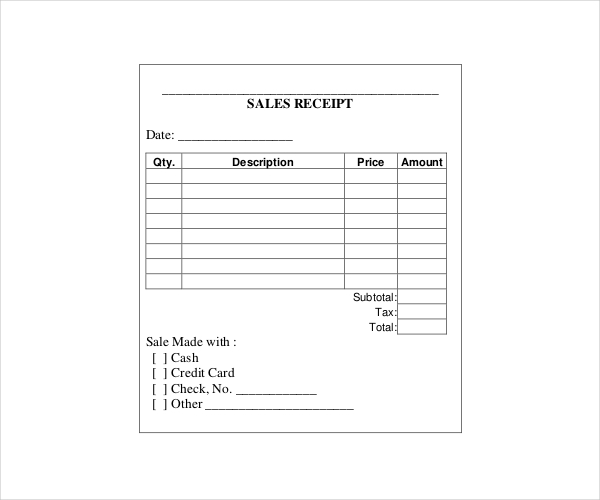

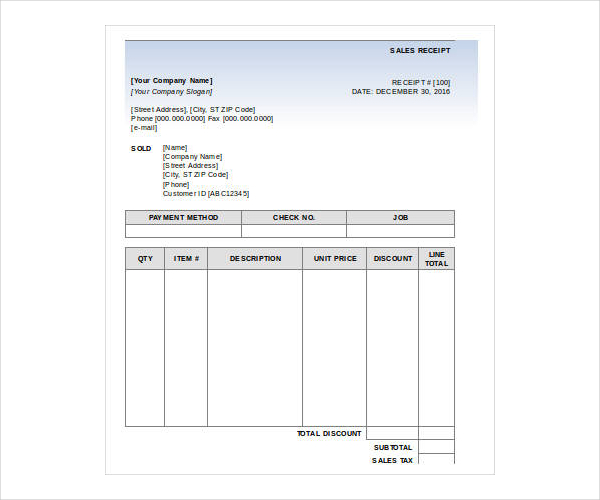

Sales Receipt Template

Simple Sales Receipt Template

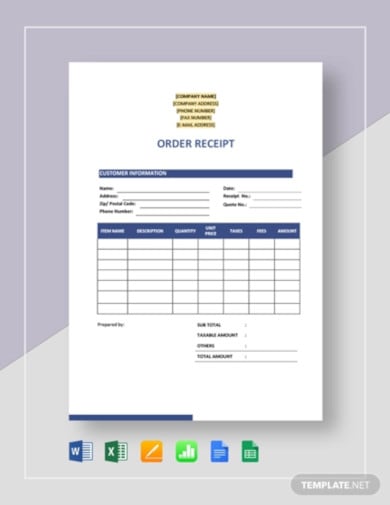

Order Receipt Template

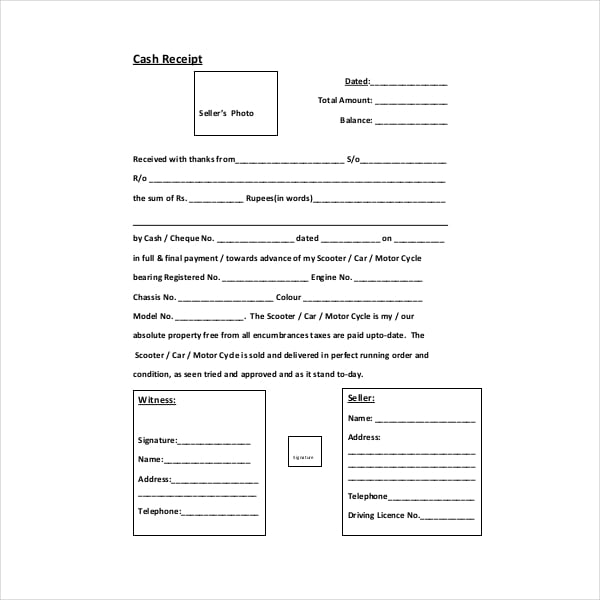

Vehicle Sale Receipt Template

Sample Vehicle Sale Receipt Template

Free Transport Receipt Template

Free Property Rent Receipt Template

Free Simple Property Rent Receipt Template

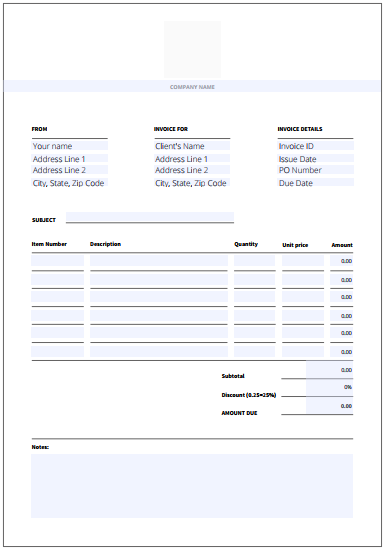

Business Receipt and Invoice Template

https://blog.toggl.com/

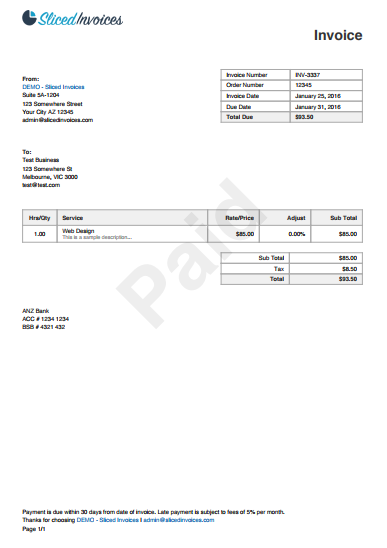

Financial Receipt and Invoice Template

https://slicedinvoices.com

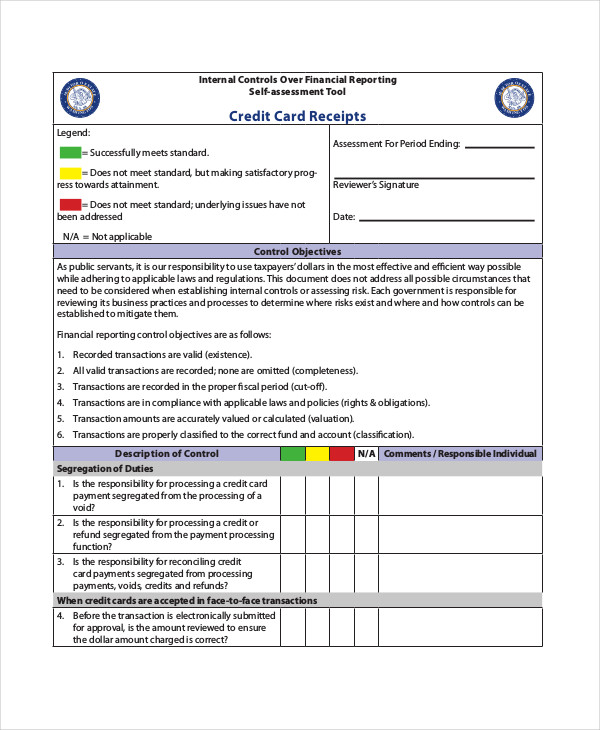

Credit Card Financial Receipt Example

sao.wa.gov

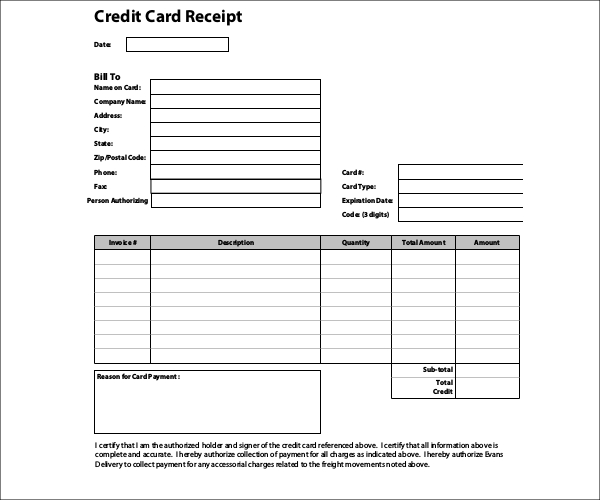

Sample Credit Card Receipt

static1.squarespace.com

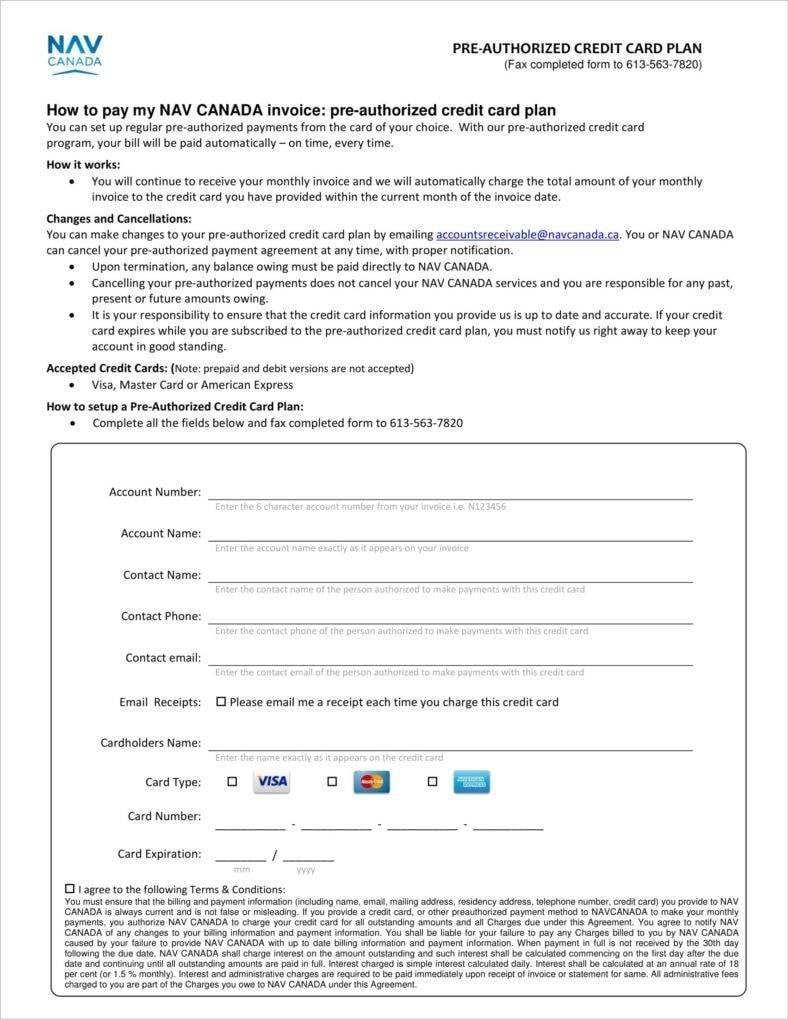

Credit Card Receipt Form

navcanada.ca

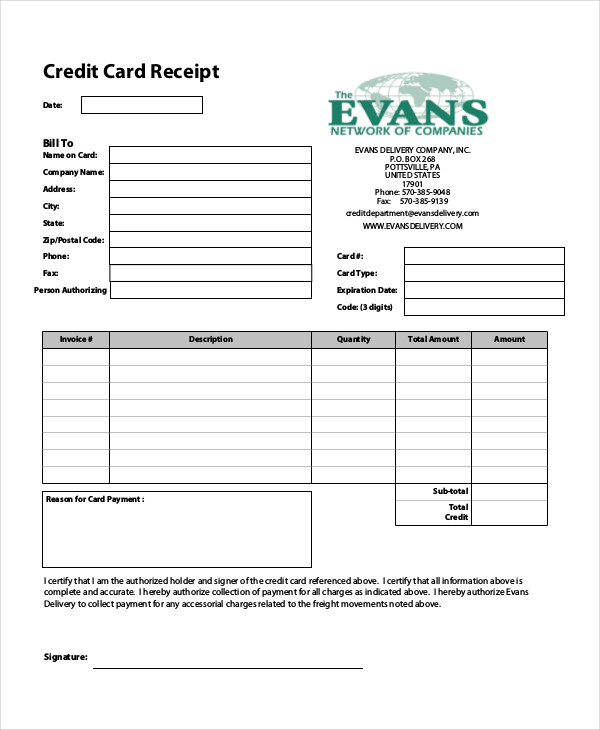

Example Credit Card Receipt

static1.squarespace.com

Credit Card Payment Receipt Template

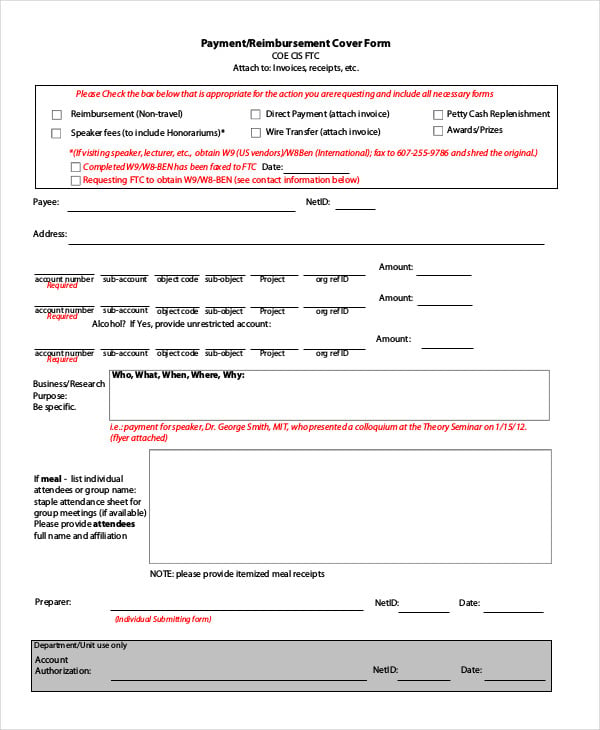

cee.cornell.edu

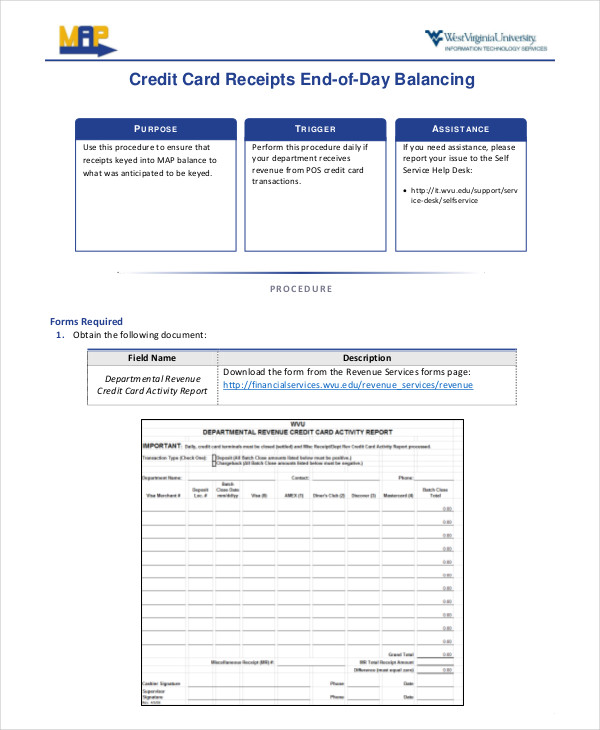

End-of-Day Credit Card Receipt Form

it.wvu.edu

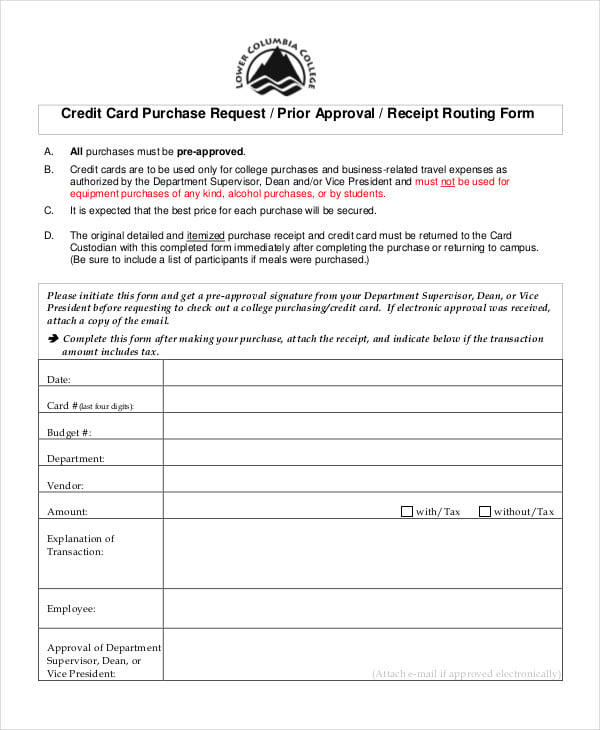

Credit Card Purchase Receipt Form

lcc.ctc.edu

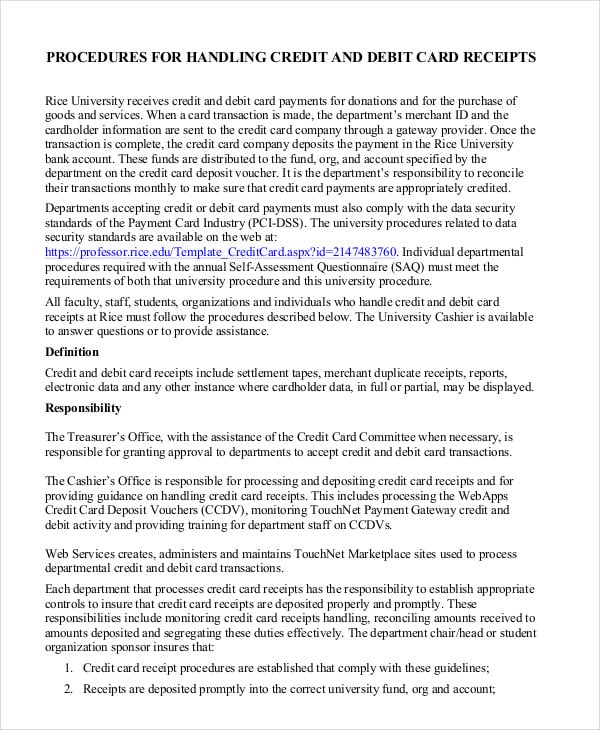

Sample Credit Card Receipt Template in Word

professor.rice.edu

The Importance of Business Receipts

Some people make the mistake of immediately throwing away their receipts the moment that they’re handed over. This is not something that you want to do as receipts can have a ton of uses. You may also see a blank receipt templates.

So here are a couple of reasons as to why one should always keep receipts:

One of the most obvious yet very important reasons as to why a person would want to keep a receipt in the first place is because you might just want to return an item that you found out you don’t particularly like or you have no use for. While there may be some stores where it’s fine if you don’t have a receipt, the majority of them are usually much stricter. Also, for those businesses which don’t require you to hand over a receipt for a return, most likely you’ll end up with store credit or only refund the amount of the lowest recent selling price. If you make too many returns without a receipt, then there’s a very high chance that you could be blacklisted from those stores. So remember that if you’re going to return something, make sure that you bring along the receipt of the item you want to hand over. You may also see printable receipts.

2. Receipts are Needed for Rebates

A rebate is a partial refund to a person who has paid too much money for a particular item. While rebates aren’t exactly as common as they were back then, there are still opportunities you can take advantage of which will allow you to send your receipts so you can get your money back. So let’s say that you found a particular product within your home that you’ve just bought fairly recently. Wouldn’t it be nice to not have to buy that product again to get the rebate? Well, so long as you have the receipt for that product neatly tucked away in a place where you can grab it at any time, then you definitely won’t have to. You may also see expense receipt templates.

3. Receipts Help Keep Track of Gaining or Spending

Another important reason as to why receipts need to make is because customers want to know just how much they were able to spend, and businesses want to know just how much they were able to make. If you’re the consumer, then it’s definitely hard to know if you’re gaining more than you’re spending, especially if you don’t have a personal budget and if you don’t have the receipts to help you keep track of your expenses. For a business, it’s really important that they keep track of all receipts as it will tell them just what kind of products were sold and just how much they were able to sell to the masses.

For consumers, it’s best to keep or scan all of the receipts within the month. If you see that you’re going way beyond your budget, then you should go over your receipts to help you figure out as to why that is. Once you see all of the problems, you can then cut out all of the unnecessary spendings to help you get back on track with the simple budget.

For businesses, it’s basically the same wherein all of the copies of receipts within the month must be properly taken cared of and organized for easy access. Try to see what kind of products you think are a hit with the consumers. Knowing that can help you come up with the right decisions in regards to what it is you should be selling or what you should focus on producing. For example, if you see that a particular product is gaining more attention and that customers keep buying it, then you can decide to increase the production of that product to meet with its demand. All you need to do help you is to go through the receipts properly and assess what your customers are frequently buying. You may also see receipt templates in pdf.

4. Receipts Make Tax Time Less Stressful

If you’ve still kept all of your receipts within the past year, then you’ll see that they’re extremely handy when it’s time to tally up the taxes. You no longer have to guess what tax-deductible expenses you’ve made within the past year. The only thing that you have to do is go through all of the receipts you’ve kept to help you out. You may also see a receipt is important for business.

It’s best recommended that you make use of three files, but you can customize the system in whatever way that works for you. Every time you come from spending like on a shopping spree, you should take a moment and go through all of the receipts with a highlighter in hand. You’re going to need to look for items that fit into these categories: work or business-related, charitable donations, and medical expenses. You may also see word receipt templates.

Highlight all of those purchases and then place them in the appropriate folder so that you’ll be ready for tax time. If you have a scanner, then you should make use of it as it’s one of the best options you can take when it comes to being organized and having less paper strewn about. You may also see work receipt templates.

Reverse Goods and Services Receipt

uc.edu

Example of Goods and Services Receipt

intranet.secure.griffith.edu.au

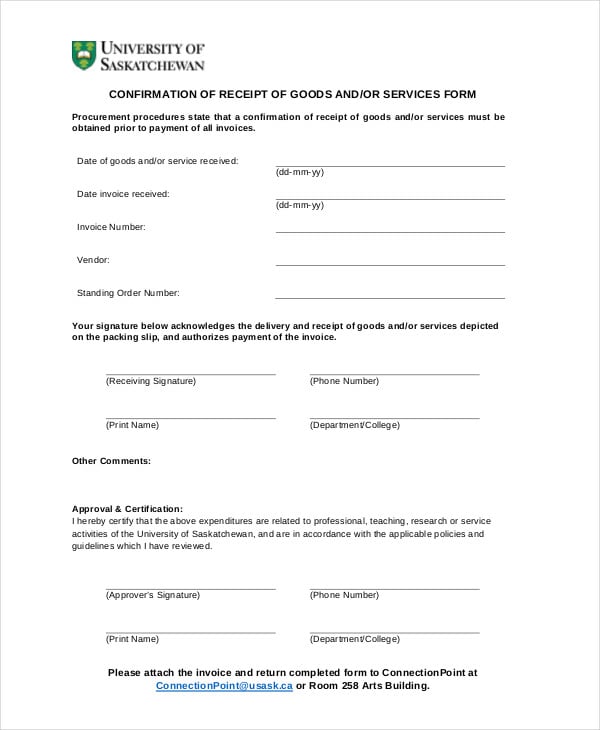

Confirmation of Receipt of Goods and Services Form

usask.ca

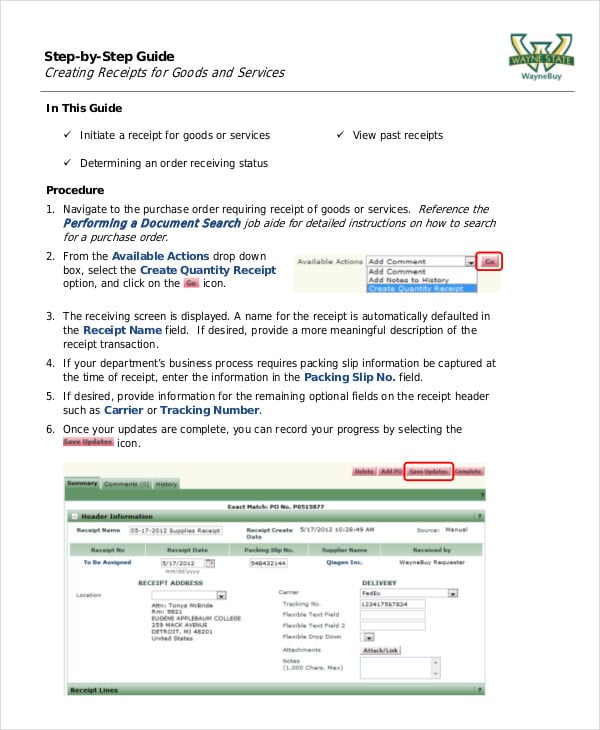

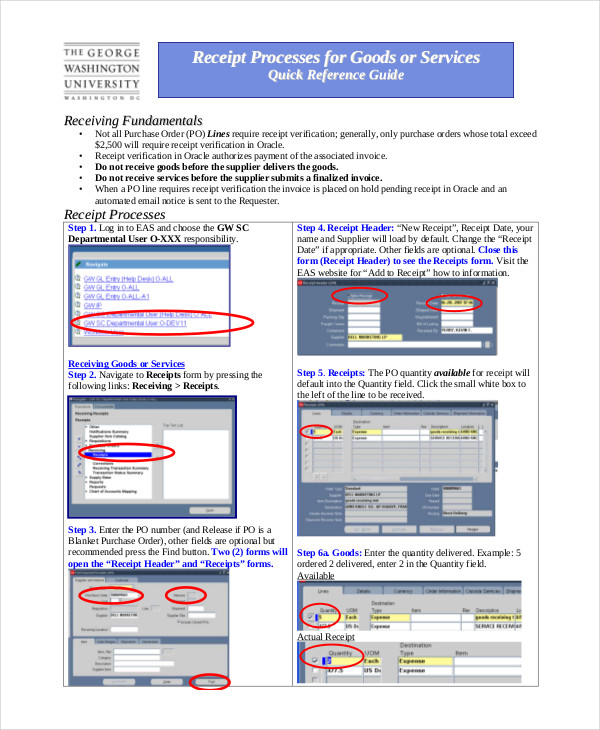

Receipts for Goods and Services

procurement.wayne.edu

Goods and Services Purchase Receipt

saig.gwu.edu

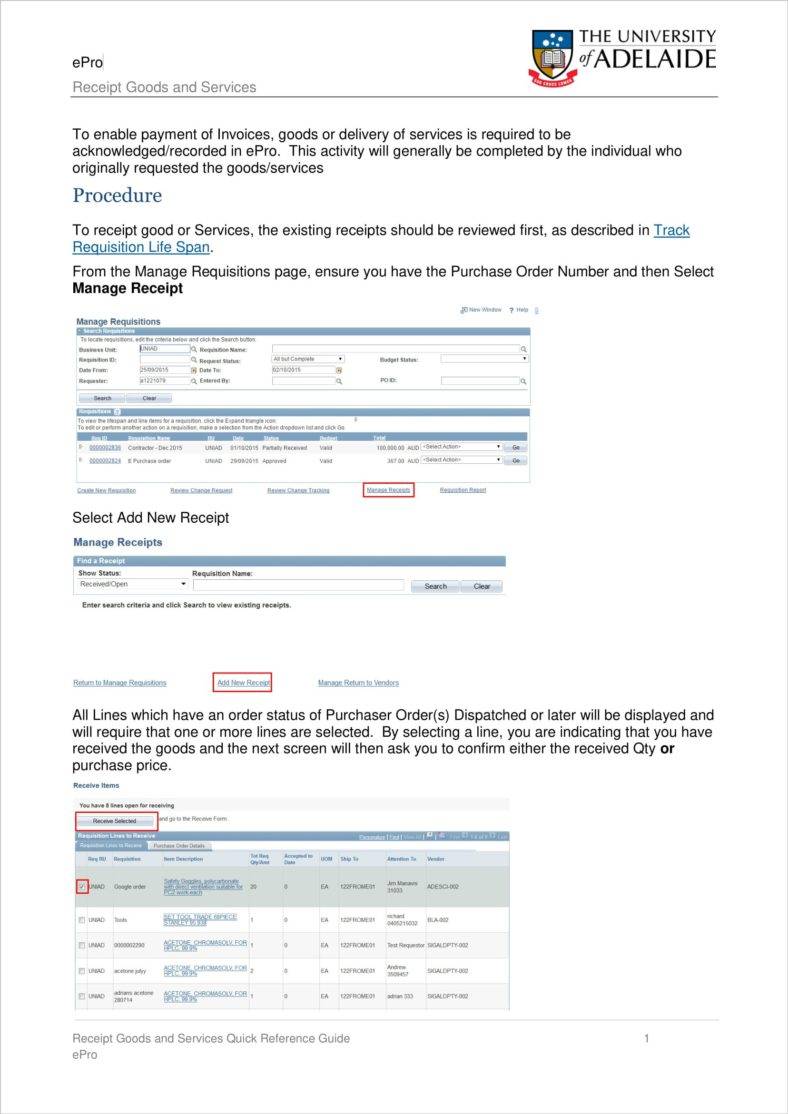

Goods and Services Receipt Sample

adelaide.edu.au

How to Write a Receipt

Now that you’ve learned the reasons as to why receipts are so important, then next thing is to learn how to actually make them. When running a business, or when making any type of sale, it is wise to have a receipt available for your records as well as for the buyer’s records. The receipt basically serves as something akin to a contract agreement between you and the buyer, and it can help you keep track of all your expenses.

So here are the steps you’re going to need to follow to help you create your own receipts:

1. For Creating a Receipt

Buy carbon copy receipts to ensure the process is sped up. If you’re going to handwrite all of the receipts you plan on making, then you should definitely invest in a pad of carbon copy receipts so that you’ll be able to write down all of the receipts while at the same time gaining two copies of it. The copies are meant for you and the buyer. You may also see donation receipt templates.

- Carbon copy receipts are often also labeled with the necessary information for a sales receipt, or they may already have an outlined template where all you’ll need to do is fill out all of the necessary information that the receipt should contain in a neat and proper manner.

Write down all handwritten receipts in dark ink. You want to make sure that your customers are able to read whatever it is you placed on the receipts you’ve made. So to ensure that they’re legible, it’s best that you go with pens that have dark ink. You want the receipt to be a permanent record, so you shouldn’t make use of pencil or light colored ink. The reason is that both tend to fade over time, and a receipt won’t exactly be helpful if you aren’t able to read whatever information is on it. You may also see sample receipts.

- If you’re going to write these receipts, then you have to remember to write in large, clear writing that makes it easier to read for just about everyone. If you are using carbon copy receipts, press down as you write to ensure that the ink bleeds into the paper and into the second and third copy of the receipt; thus ensuring that all of the copies have every piece of information that it needs. You may also see store receipts.

Use a printed company stamp or preprinted blank receipts that contain the name of your company. If you want to make your receipts official in the eyes of your customers, then you want to make sure that there’s a stamp of your company logo on top of all the receipts that you’re going to have to make. You also have the option to go with preprinted receipts that already contains both the name of your company and the logo. The reason as to why you should do this is because you want to make it clear to the customer that the products being sold are coming from your business and will be a useful reference in the event the receipt needs to be referred to in the future.

2. Make Sure That All of Your Receipts Have the Necessary Information

Whether you’re handwriting the receipt or if you’re creating a template in a text document through your company’s computer, you need to make sure that the following must be in them:

- Details regarding the vendor

- Details regarding the buyer

- Date in which the transaction took place

- Details regarding the type of product that was purchased

- The amount of money being exchanged during the transaction

- The method of payment

- Signatures from both the buyer and the seller

If you’re leasing out space, then you need to make sure that you have all of the necessary information for the rent receipt. There are some businesses who offer to have certain areas within their establishment to be rented out to others. So when the time comes for when renters need to pay up, it’s required to hand them over the rent receipt as soon as the payment has been made.

These receipts are very helpful as they can keep track as to who has been able to pay rent, or who have yet to pay even a single cent. Also, it’s very helpful for the renters as it allows them to keep track of the payments they have already made and let them know when the next payment is.

If you need to create a rent receipt template, then make sure that the following basic information has to be included:

- The total amount of rent that has been paid

- The date on which the rent was paid

- The complete name of the renter

- The complete name of the landlord (in this case the business renting out space)

- The complete address of the rental unit

- The pay period for the rent

- The payment method of the rent (cash, check, etc.)

- The signature of both the landlord and the renter

Consider making use of a free receipt template. In the event that you want to go create printed receipts for your business or your company, then you should know that there are a ton of free receipt templates you can find just about anywhere online; we even have a lot of them available here on our very own site if you wish to use them. You want to go with the ones you think that you’re comfortable with using. Once you’ve chosen the template that you want, the only thing that you’ll need to do next is print them out and stamp them with your company name to personalize them for your daily transactions.

The Purpose and Key Elements of a Receipt

While we’ve already talked about its importance, there are still other purposes that we have yet to tackle and we also need to talk about the key elements that just about every receipt should have. Knowing these will help you come up with the receipts that your business needs.

So here are the following things you should learn:

1. Recognize the True Purpose of a Receipt

Remember that the reason as to why you should always keep your receipts is because they will help you keep track of your business’s income for tax-related purposes. So no matter what kind of receipt you end up making, you need to be sure to save all of them as you may be required to show proof of your expenses on your taxes. You should always provide a receipt to your customers if you are running a simple business. If you’re the consumer, then you should know that businesses should always offer you a receipt no matter what kind of transaction you make with them; so long as it’s finalized, then you should always get one.

- Whenever you purchase items or services that are expensive than most, it’s considered mandatory that a receipt should be created for the transaction. The receipt acts as a form of insurance in the event that there are any legal issues which revolve around the transaction, as both parties can make use of the receipt as proof in court.

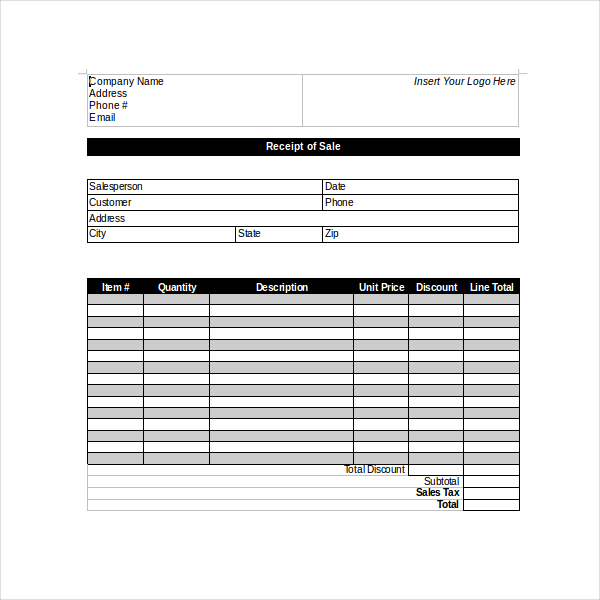

Business Sales Receipt Template

wikidownload.com

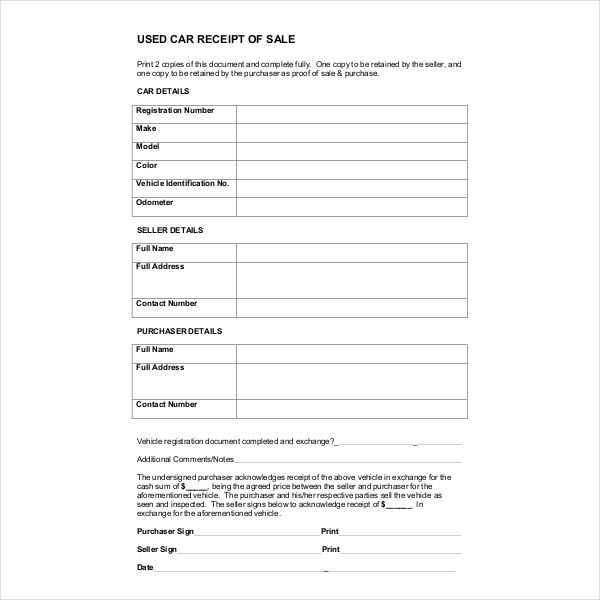

Used Car Sales Receipt Template

wikidownload.com

Printable Sales Receipt Template in PDF

hooverwebdesign.com

Sample Sales Receipt Template in Word

ws.org

Cash Sales Receipt Template

bestcardealer.in

2. Be Aware of the Most Common Types of Business Receipts

When you think about it, you can write up a receipt for just about any transaction you come up with. It doesn’t matter what kind of transaction it may be, so long as there’s an item that’s exchanged for something that’s of equal value (almost always money), then having a receipt which contains all the details regarding the transaction will definitely be useful. There are a couple of receipts that you’re sure to encounter at least once in your lifetime.

So here is a list of such receipts:

- Receipt of payment. In order for a transaction to be processed, the person that’s selling the product will need to create a receipt for payment. This type of receipt will need to include information such as the receipt number, along with the date of when the transaction took place and the amount of money the seller gained. In the event that the buyer paid the seller in cash, then there should be a note on the receipt which says “cash”. If the buyer paid through check, then there should be a record of the check number. If the buyer decided to pay via credit card, then what should be noted is the type of credit card that the customer used (American Express, Visa, Mastercard), including the last four digits of the card.

- Medical receipt. This is basically a bill of acknowledgment for items that are purchased for medical-related purposes. These would include items such as medicine or even surgical equipment that the buyer wishes to purchase. A medical receipt should include the diagnosis code, the date of visit, the consultation time, and the total amount that has been paid.

- Sales receipt. This is the kind of receipt that you’ll end up seeing a lot, especially if you’re the type of person who tends to enjoy shopping sprees. If you’re the person that’s in charge of handling a business, then you will give a sales receipt to a customer after you have been able to finalize the purchase of any item that your business sells. This is an important receipt that every customer needs as it basically serves as the proof of purchase of a particular product and can be used by customers to make returns when necessary. So this type of receipt should include the amount of payment that has been made, the date in which the sale took place, the name and price of the item, and the name of the person who processed the transaction.

- Rent receipt. If you’re the landlord, then you’ll know just how important it is that you create a rent receipt to any tenant that has managed to pay up the rent. This is what will serve as proof that a particular tenant that is renting out property owned by someone else has been able to pay rent. So this type of rent should include the complete names of both the landlord and the tenant, the complete address of the rental property, the billing period, the rent amount, and the start date and end date of the rental agreement.

- Online receipt. There will be times wherein you might purchase products via online means. When that happens, you should be sent an online receipt and receive them in your inbox. Online or E-receipts are digital receipts that contain the same information as a receipt of payment and act as proof of purchase for items bought online. So try not to delete these the moment that you actually get them. If you’re the person that has to create these online receipts, then you need to make sure that it has all of the necessary information before you send it over to the customer.

3. Understand the Key Elements of a Receipt

If you’re the seller of a particular item or service, then you need to be familiar with these key pieces of information that just about every receipt should contain:

- Vendor details – This is the basic details regarding the seller of the product or service. This should include the complete name of the seller (or the company name of the seller), the seller’s complete address and the seller’s contact information (email address and phone number) on top of the receipt. You should also include the name of the store manager or owner of the business or company as customers may want to talk straight to them during certain situations where it’s needed.

- Vendee details – This is basically another way of saying the details of the “buyer” in the transaction. So the only thing that you need to write is both the first and last name of the vendee or the buyer.

- Date of the transaction – This should be the exact date on which the transaction took place. Make sure that you include the month, day, and year as the information can be very helpful in letting one know when the transaction took place, for keeping track of expenses, and for tax purposes. You may also see lease receipt templates.

- The product details – This where you will be writing a brief description of the products or the services that were sold to a buyer. So it should include the name of the product, the quantity that it was sold in, the product number, and any other information that will help identify what kind of product or service that was purchased. This element will be useful if you need to remember the sale in the future. You may also see simple receipt templates.

- The amount of the transaction – When you’re writing this section of the receipt, you’re going to have to break down the total amount into the original price, the tax, labor charges, and any discounts or promotions. By breaking down the total price into the receipt, it will make the sale more valid and specific. You may also see sample restaurant receipt templates.

- The method of payment – Basically, how the buyer was able to pay for whatever product or service that was purchased. You’ll have to take note if the buyer was able to make the payment through cash, check, credit card or debit card.

- Signature from both the buyer and the vendor – This is one of the most important things that you have to guarantee has to be on the receipt. If the receipt has a signature from both sides of the transaction, then it basically states that the two have come to an agreement regarding the finalization of the transaction. So once the receipt has been drawn up or printed out and the buyer has paid you, mark the bottom of the receipt as “Paid” and get the signature of the seller. You should also provide your signature once it’s done as you’ll also be putting it in your records where you can pull it out whenever you need to. You may also like receipt formats.

If you would like to learn more in regards to how you should go about in creating business receipts, then all you have to do is go to our site, find the articles that contain the information you need, and utilize whatever you’re able to gather to help you and your business out. You may also see sample rental receipt templates.