19+ Restaurant Receipt Templates

Restaurants are establishments that are typically dedicated to the selling of edible food items to service customers as their main…

Sep 04, 2023

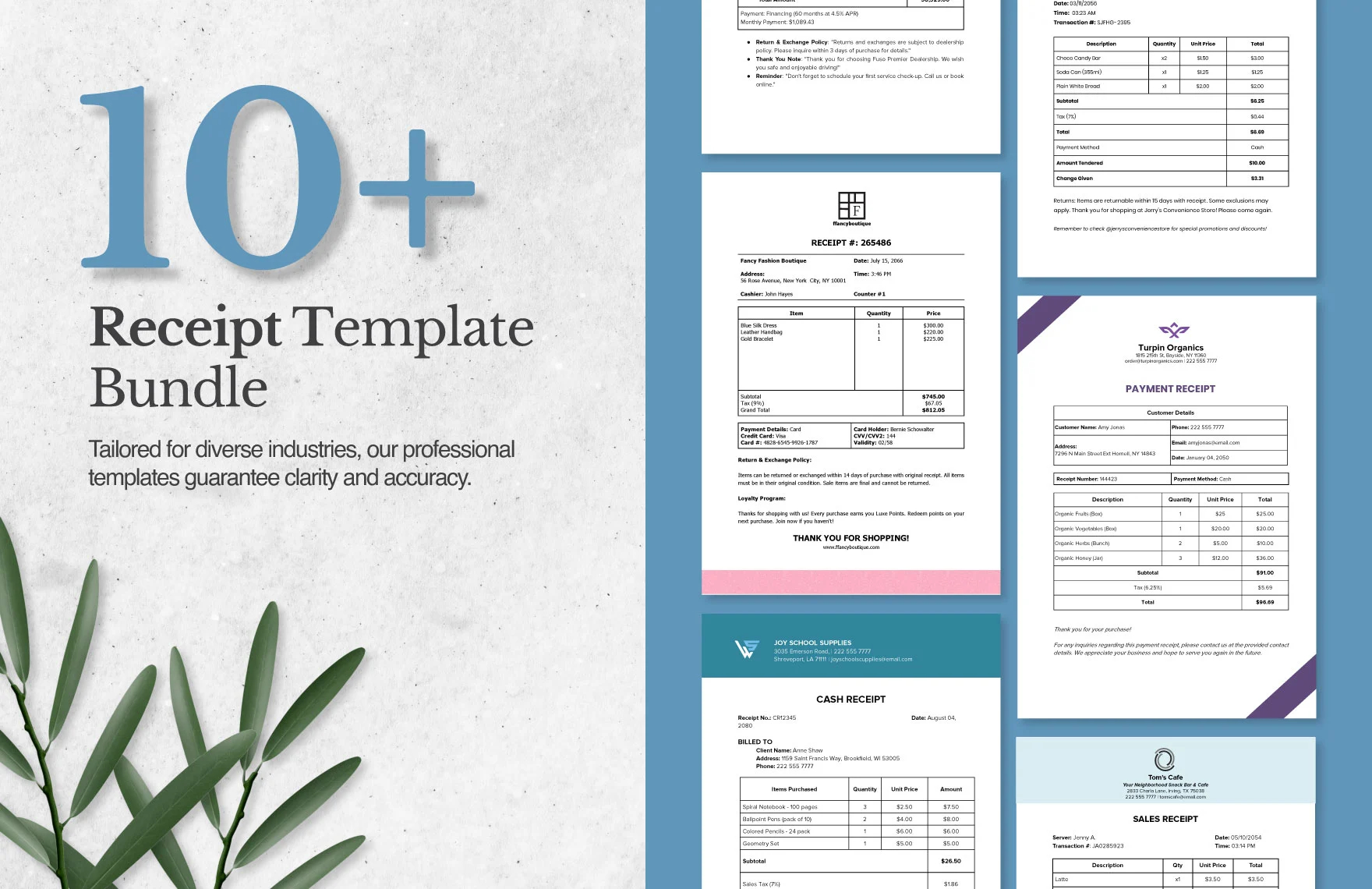

If you’re going to make a transaction, then you expect to receive a receipt at the end so that you can acquire details such as how much you bought a product or service for, the date in which you bought it, the amount you’ve paid, how you made the payment, etc. You may also like receipt templates.

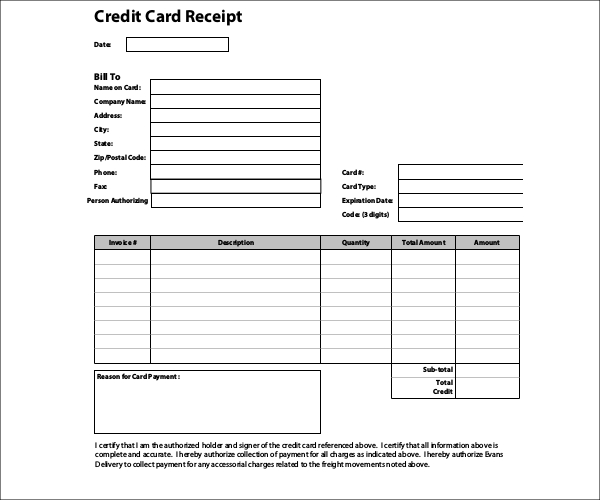

But what if the payment is made via credit card? You’ll need to gain more than just the basic information as payment receipts which contain credit card information are different compared to the rest. That’s why this article is going to focus on how you will go about in creating such a receipt, as well as helping you learn about its importance.

static1.squarespace.com

navcanada.ca

static1.squarespace.com

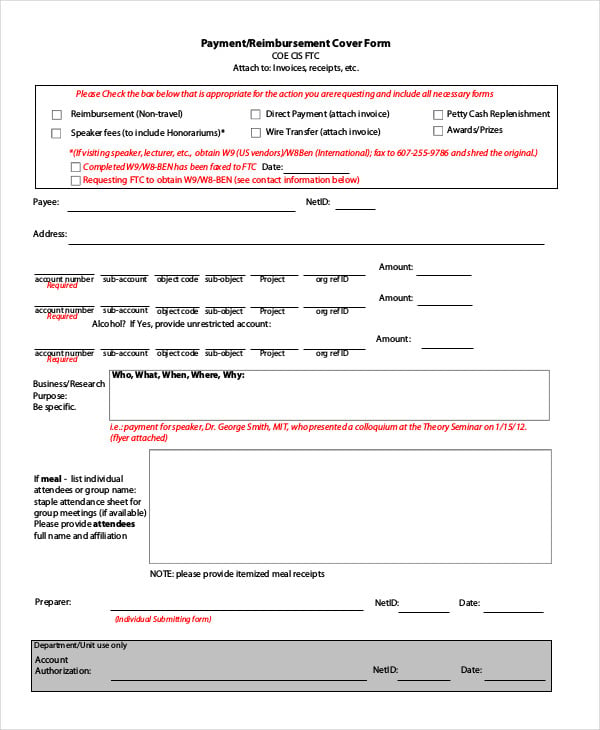

cee.cornell.edu

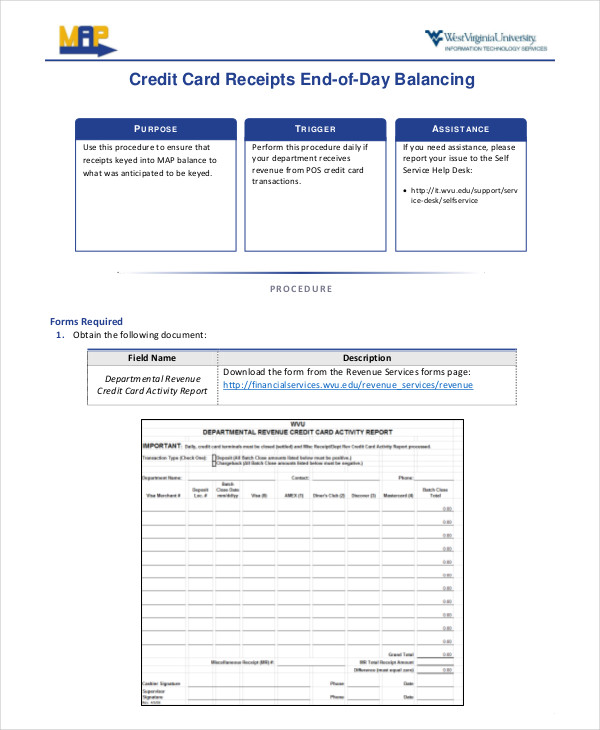

it.wvu.edu

No matter what type of receipt you’re intending to make, you need to be able to give sufficient information regarding the transaction that both parties can benefit and make use of. The information that each receipt requires differs based on factors such as the type of transaction, method of payment, environment (physical or virtual), etc. You may also like receipt formats.

So how about if you’re making one for a credit card receipt? You’re going to have to learn what it should contain so that those who pay via credit card will feel safe knowing that you’re able to provide them with all the details regarding how the transaction took place through the use of their cards. You may also see blank receipt templates.

Here is a list of all the information that a credit card receipt should contain:

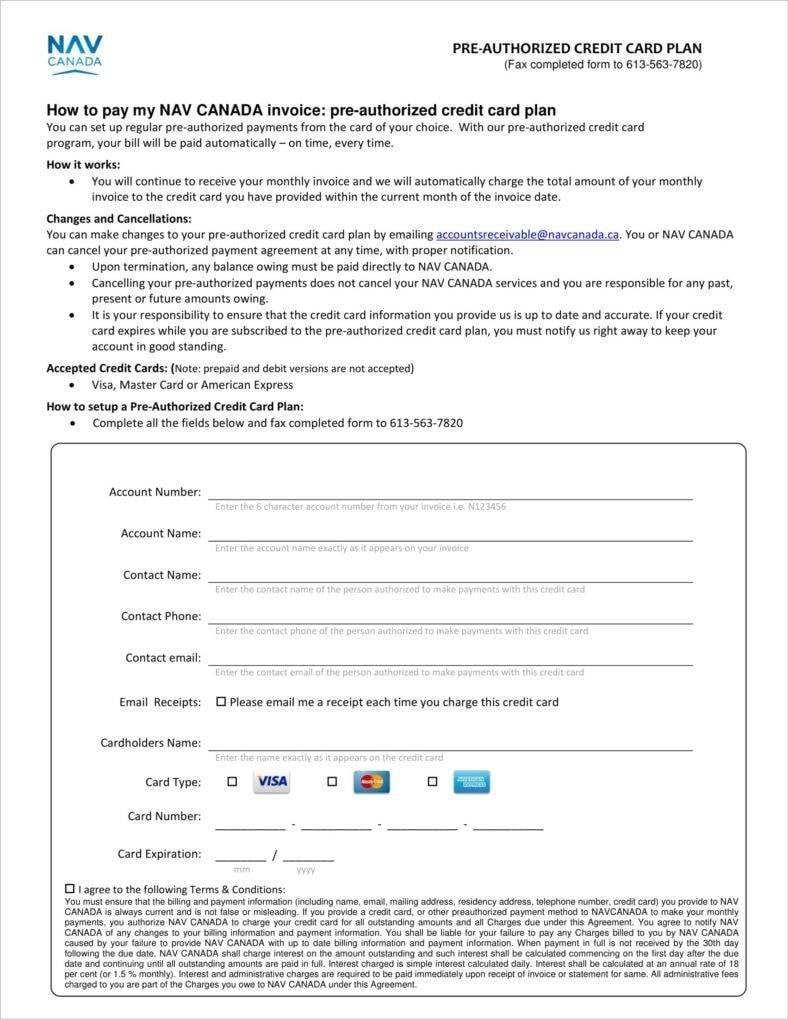

This is basically all of the important information regarding the company who will be receiving payment via credit card. So what this section of the receipt should contain is the name of the merchant, the country or state where he/she is located, contact details, and/or the point of banking location. You may also like receipt sample templates.

The reason as to why all of this has to be included in the credit card receipt is because there’s always that possibility that a customer would want to contact the merchant regarding the payment details. By knowing the merchant’s contact details or where the merchant is situated in, the customer may either call to learn more about the transaction or go straight to the establishment itself if in the event he/she wishes to do something such as file a customer complaint regarding the transaction.

This is just as important as the amount of money that was taken from the buyer’s credit card. By placing the date on the credit card receipt, both the merchant and the buyer can verify as to when the transaction took place. This is very important for the business as there’s a possibility that the buyer will be paying for a product via installments. Going through the credit card receipt can tell just how much charged as well as when the buyer will need to make his/her next payment.

Also, remember that there’s a specific date format that every state or country uses. When you’re typing down the date of the transaction, it’s best that you follow how the rest of the other companies within your area does it. While you could always go with the standard mm/dd/yyyy format, it’s best that you stick with what everyone within your area is used to as you don’t want anyone to be confused. You may also like business receipt templates.

This is where you place the information regarding whatever product or service was purchased through the customer’s credit card. So this should include an accurate description of the goods or services such as how much they were priced and the applicable taxes. You need to make sure that all of that is included in the receipt because having all of that information will help in identifying the transaction. Because let’s say that you need to pull up the details regarding a customers’ credit card purchase on a particular date. While there are a ton of receipts made during that specific date, you can make things much easier on yourself by knowing what was purchased and searching that in your company’s system. You may also like blank receipt samples.

In the event that there is no currency is identified on the receipt, the transaction is considered to have taken place in the currency that is legal tender at the point of sale. Basically, if the merchant sees that there isn’t any specified type of currency within the receipt, then the kind of currency will be used will depend on the country of where the merchant is situated in. If the merchant decides to offer multiple currencies, then the sample sales receipt will need to contain the following information:

Be sure that you don’t leave any of that out as it’s all very important.

There has to be a legible imprint of the card on the credit card receipt. The merchant may also electronically record the customer’s card information and the merchant location. If in the event that the transaction has been completed even without a card imprint or electronically derived card information, then the merchant will have to note legibly in the receipt regarding all the details that will identify the cardholder, the merchant, and the card issuer.

So this section of the receipt will need to have the name and address of the merchant, the complete name and trade of the card issuer as it appears on the credit card, the account number, the security code, the credit card’s expiration date, the name of the cardholder and the name of the company. If the transaction is completed without obtaining a card imprint or electronically derived card information, then it’s considered that the merchant has been able to verify the true identity of the customer as the person who owns the credit card. You may also like free receipt templates.

Mail orders, telephone orders, pre-authorized orders and e-commerce orders, may be completed without a card imprint.

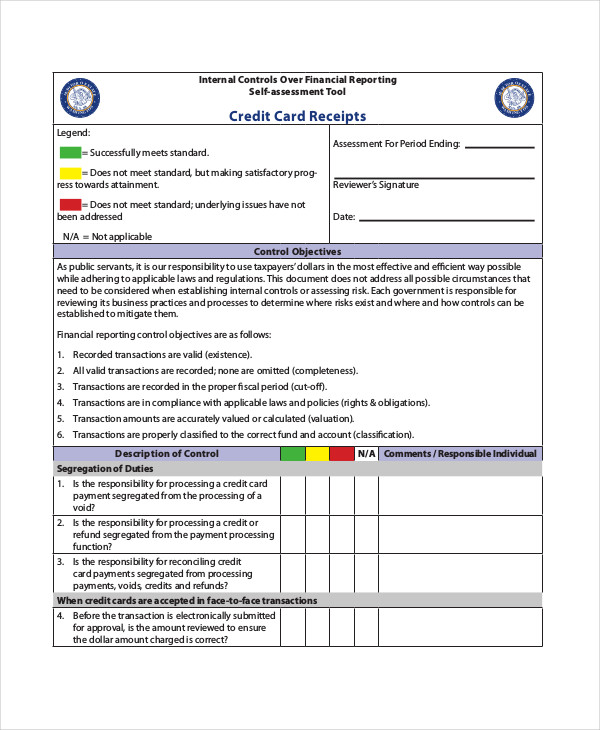

sao.wa.gov

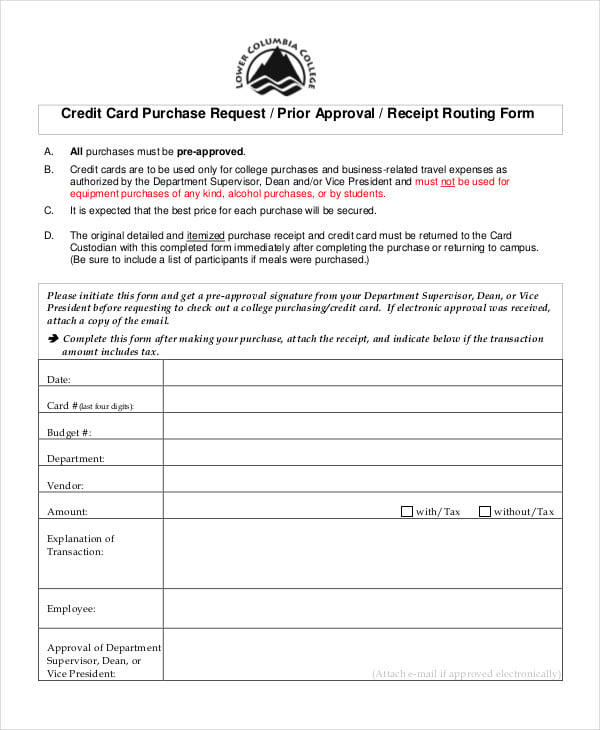

lcc.ctc.edu

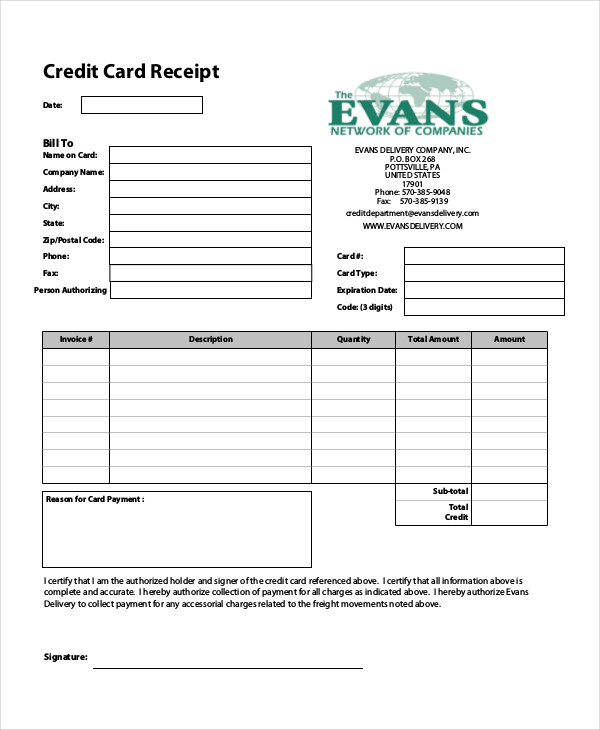

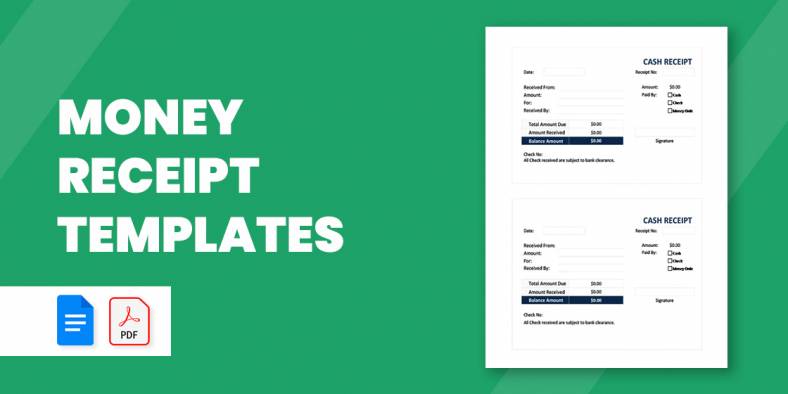

professor.rice.edu

This is very important as you can think of it in the same way as signing a contract agreement where the signature basically shows proof that the person signing has gone through the terms, as well as understanding and agreeing with them. You’ll want the cardholder to provide you with his/her signature face-to-face so that you can verify that he/she is indeed the person who owns the credit card. Although, you can always ask the customer to provide you with his/her personal identification number (PIN), wherein you don’t really need to obtain the customer’s signature.

Once the merchant has been able to obtain the signature, he/she must:

Just as important as the cardholder’s signature, the merchant will need to provide his/her signature on It is recommended that only the last four digits of the primary account number be printed on the receipt. the receipt as this will ensure that the merchant has also agreed to the terms of the transaction. You may also like sample receipt templates.

The primary account number (PAN) must be truncated on all cardholder-activated terminal sales receipts. Country or state laws require that all purchase via credit cards require this piece of information within the receipt. It is recommended that only the last four digits of the primary account number be printed on the receipt. he name and last four digits of the card’s account number will need to match with whatever is printed on the credit card receipt. You may also see free receipt templates.

The merchant will need to provide accurate information of whatever is placed within the cardholder’s credit card into the receipt. This will include everything from the serial number, expiration date, the jurisdiction of the issue, customer name (in the event that the customer’s name is not similar to the one found in the card, and the customer address. You may also see receipt formats in a word.

The transaction certificate is not required on the sales receipt. However, should the processing bank choose to record the receipt of a transaction certificate on the sales receipt, then the merchant will need to enter the complete transaction certificate into the receipt.

These are the things that every credit card receipt should not contain. So here are the following:

In the event that you would like to learn more about credit card receipts or anything related to this particular topic (such as how to fill up a credit card authorization form), then all you have to do is go through our site, find the articles that contain whatever information you need, and use the information you’re able to gather to help you and your company out.

Restaurants are establishments that are typically dedicated to the selling of edible food items to service customers as their main…

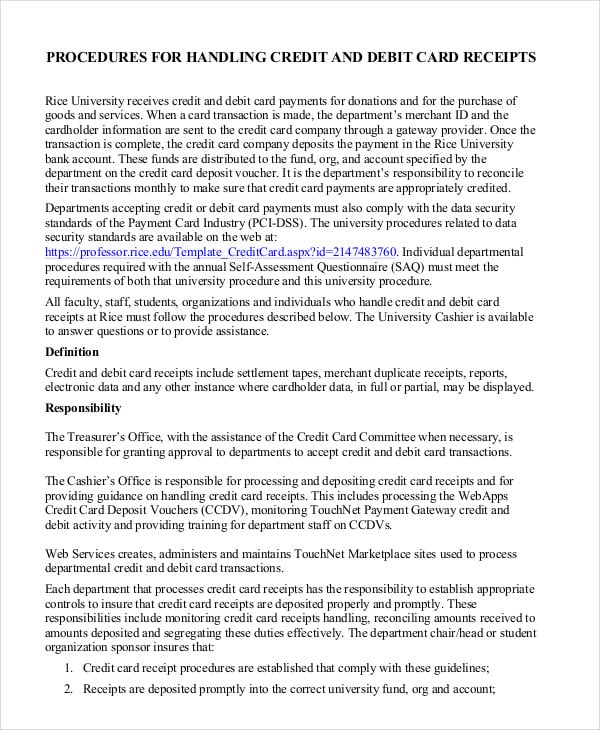

Whether you need to keep neat records of received payments, or are looking for a template that helps you look…

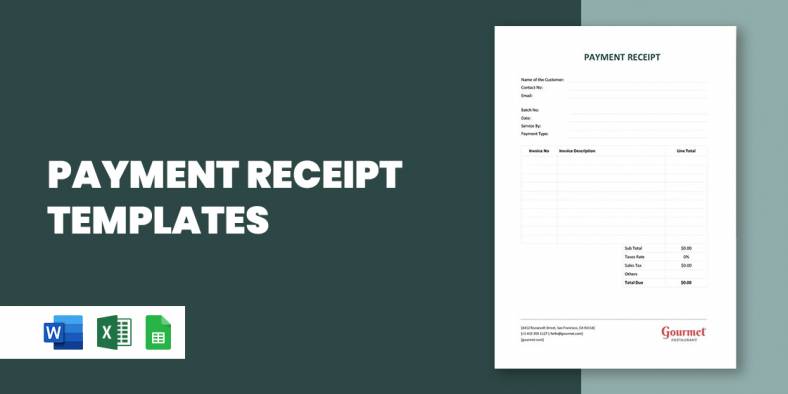

Any type of receipt serves as a receipt acknowledgment and proof that a certain product or type of service has…

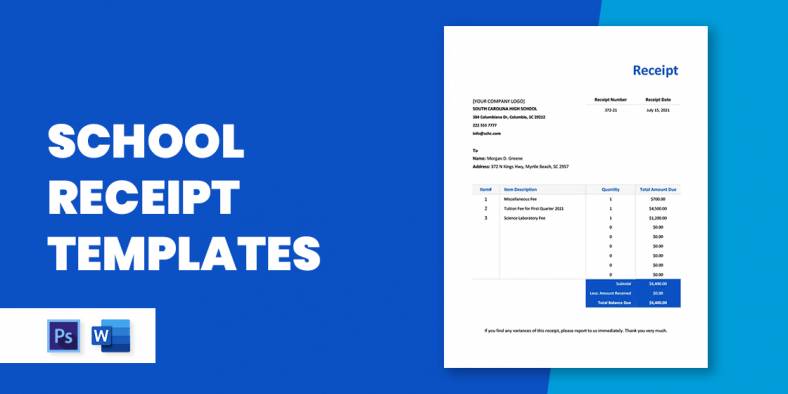

For any business that only accepts money as mode of payment from their customers, a good system for calculating the…

If you’re going to run a business that focuses on selling products to customers, then both you and the people…

Daycare centers take care of small kids while their parents are busy working in the office. A daycare center uses…

Companies always need to check on their finances as their sustainability, progress, or decline, relies on the figures. Accuracy and…

There is a need for the receipt whenever church donation is made or given. This donation receipt works as the…

An investment receipt is a record that recognizes that an individual has obtained capital or assets in compensation as a…