10+ Employee Stock Purchase Plan Templates in PDF | Word

An employee stock purchase plan (ESPP) is a program the is run by any corporation and that allows participating employees…

Feb 17, 2020

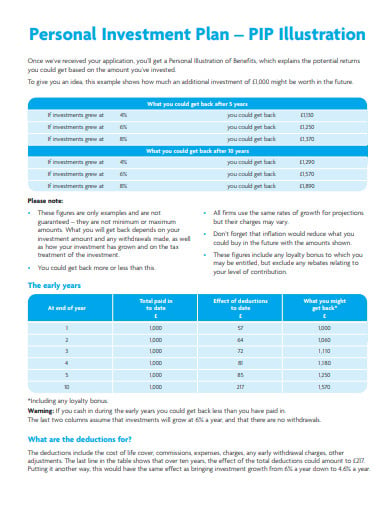

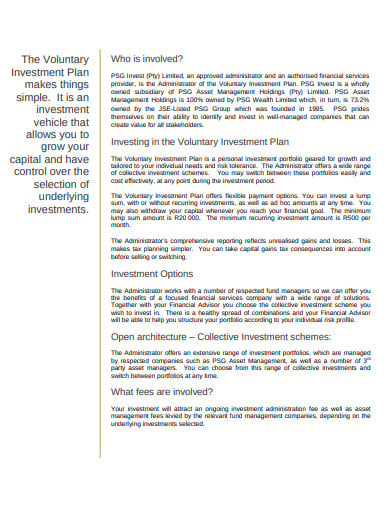

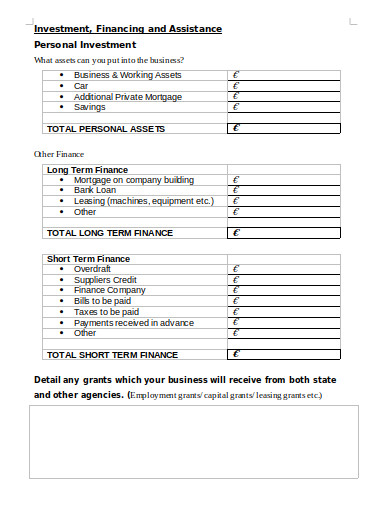

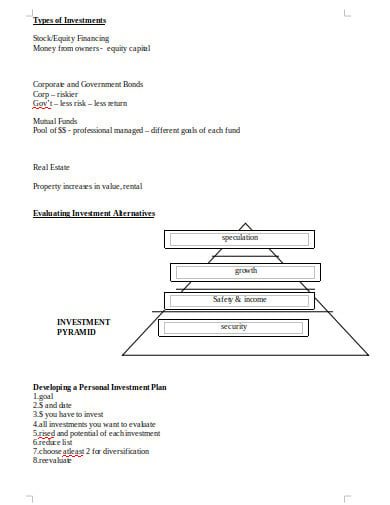

The personal investment invests an amount of money that is something funded by a person, other than by a company or organization, or these investments as a whole. And the favored personal investments are the real estate and precious metals invested to get good fixed return monthly or annually. A personal investor invests in the assets which are will value back. the personal investor utilizes analysis of the financial reports of the issuer to evaluate the security.

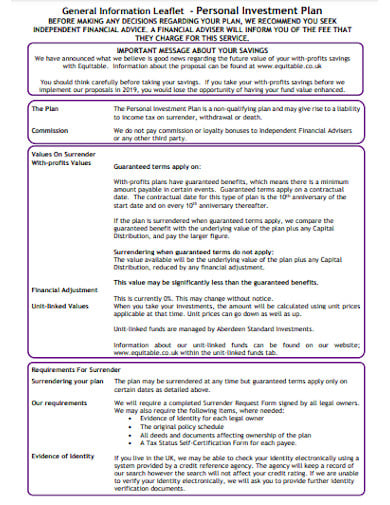

equitable.co.uk

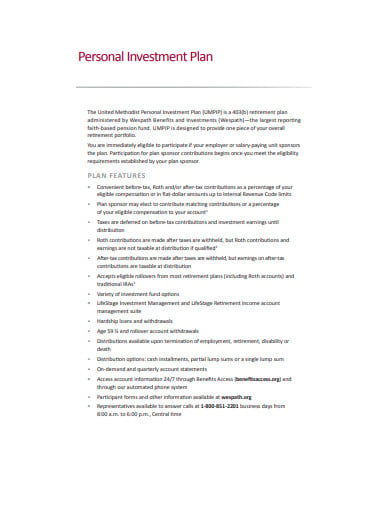

equitable.co.uk wespath.org

wespath.org bristol.ac.uk

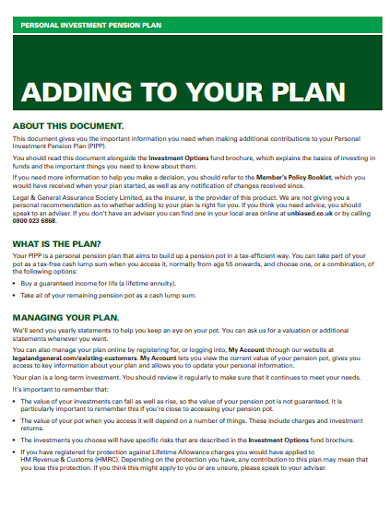

bristol.ac.uk ioof.com.au

ioof.com.au legalandgeneral.com

legalandgeneral.com halifax.co.uk

halifax.co.uk jacksonstephen.co.uk

jacksonstephen.co.uk psg.co.za

psg.co.za nzqa.govt

nzqa.govt localenterprise.ie

localenterprise.ie iugaza.edu.ps

iugaza.edu.ps weebly.com

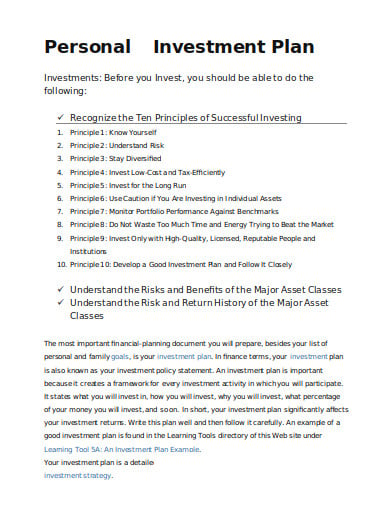

weebly.comThe next stage in drafting the investment strategy is to make sure how much risk appetite that you are agreeable to take. While speaking generally, the young you are, the plenty amount of risk you wish to take, and since the investment portfolio has time in hand to get over from the losses. When you are older, you must attain less risky investments and rather invests more in the upfront to advance growth. Therefore, the riskier investments have the ability for maximum returns but also have major losses.

The final stage is to make sure where to invest. There might be various accounts that you can utilize for personal investments. Eventually, the budget, objectives and risk tolerance would assist guide towards the correct types of investment for betterment. You must consider securities like land, metal assets, savings accounts or CDs, physical items and education savings.

And in the last stages mentioned that it is not clever enough to simply leave investments alone. Every now and often, you might keep check-in to look into how the investments are performing and make sure if you need to rebalance. It is essential to be sure that you aren’t putting enough money into your investments monthly and you are keeping a record to reach your objectives or might be your investments more than you need to and you’re heading forward of schedule.

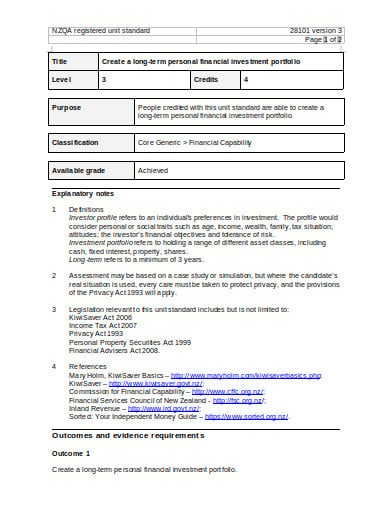

It is good to set up a realistic goal instead of wishing that you want to have enough money to retire and lead life comfortably, thinking about how much more money you’ll need. Your specific goals and objective might be to save a certain sum of money by the time you’re 65. And, when you plan of saving a certain amount of money till you reach a certain age calculate how much you need to save every month.

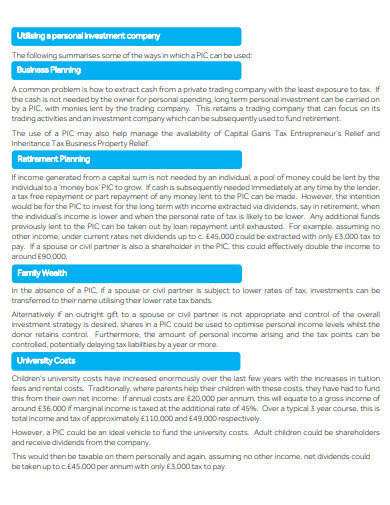

The creation of the investment policies that guides and directs the investment decisions. When you an having the financial advisor, then the investment policy statement the guidelines that you want your adviser to abide by to follow for the investment portfolio. Among these, they are to figure out the goals and objectives to achieve. And, the strategies and plans that will assist in meeting the objectives and expect the returns from the investments.

The statements have in it the detailed information on how much risk factors that you are willing to take. Also involving the type of investments that will make up the portfolio and how money needs to be assessed. It must have in it the process through which the portfolio shall be monitored and evaluated or why it is rebalanced.

An employee stock purchase plan (ESPP) is a program the is run by any corporation and that allows participating employees…

A Share Repurchase Agreement is a contract between a company and at least one of its investors where the organization…

Asset Allocation is a venture on various investment strategies that intends to adjust chance by partitioning resources among significant classifications,…

A written statement of policy on fraud suggests that the battle against fraud is embraced and sponsored at the highest…

A fraud risk assessment is a type of management that is a device utilized by the board to distinguish and…

A certificate of deposit is a certificate issued by a bank to the individual depositing money at a defined rate…

The investment commitment letters are the engagement between two organizations promising to render financial assistance or pay back the debt…

An equity investment term sheet is where the investor puts resources into an organization by buying portions of that organization…

A return on investment report (ROI) is a financial formula that is used to measure the benefit an investor will…