10+ Employee Stock Purchase Plan Templates in PDF | Word

An employee stock purchase plan (ESPP) is a program the is run by any corporation and that allows participating employees…

Jul 21, 2020

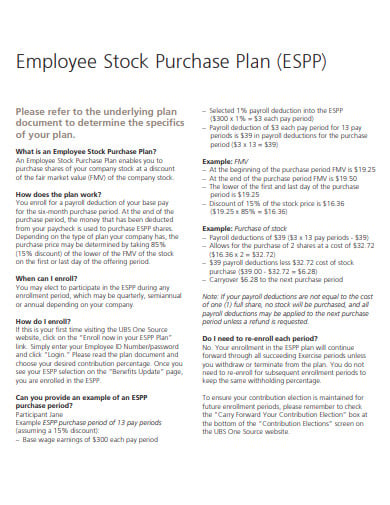

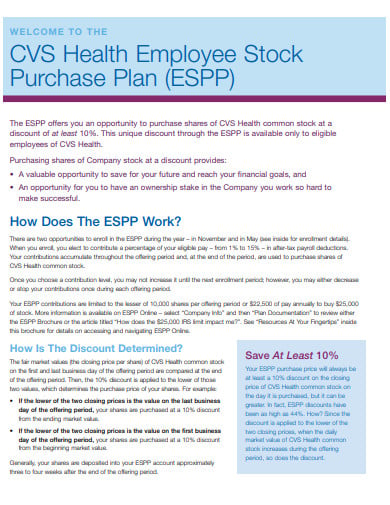

An employee stock purchase plan (ESPP) is a program the is run by any corporation and that allows participating employees to buy company stock at a discounted price. Employees make a contribution to the plan via deductions of payroll that build up between the date of the offer and the date of purchase. At the purchase date, on behalf of the participating employees, the company uses the accumulated funds of the employee to buy stock in the firm.

ubs.com

ubs.com sprint.com

sprint.com iza.org

iza.org harvard.edu

harvard.edu moog.com

moog.com benefits.ml.com

benefits.ml.com morganstanley.com

morganstanley.com smashfly.com

smashfly.com deloitte.com

deloitte.com fidelity.com

fidelity.com umsl.edu

umsl.eduESPPs can provide you with opportunities to buy company stock at a discount or at a favorable price. You can also obtain potentially favorable tax treatment on earnings through the scheme if you meet the basic holding period criteria for the shares you buy. In case your employer provides an ESPP but you’re not sure if you should participate, here’s what you need to know to help you decide if you’d like to take advantage of it or not.

A strategy for the purchasing of employee stocks helps you to buy company stocks. Owning company stock shares can be a good thing if you think the company stock price will go up but there is a range of risks involved. All investments carry one particular risk: the risk of loss because there is no guarantee that the value of your investment will increase. You can buy shares, keep them, and see their prices fall below what you paid for them. But there is another risk that not all other investments carry and that is the risk of concentration. You need to know what it means to hold a single stock position before you participate in your ESPP, and particularly if you intend to participate and keep the stock that you purchase instead of instantly selling the shares to lock in any discount you might receive.

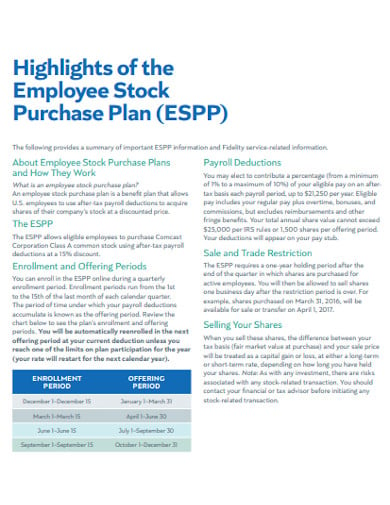

Most ESPPs are set up so you can opt to postpone a set percentage or amount of your paycheck to the plan if you enroll in one. This makes donations easy and convenient and is seen by many workers as an appealing aspect of ESPP. When you register, your employer will deduct a percentage of your paycheck into the ESPP as much as 401(k) contributions will be deducted from your salary. But unlike a typical 401(k) in which you finance the account with pre-tax deductions, after-tax money is used to make ESPP contributions.

Your employer collects your payroll contributions during an offering period and maintains them in confidence. You’ll also have a delivery date on your contract. On the purchase date, the money collected during the offering period and kept in the trust are used by the employer to buy shares of stock. From months 0 to 6, your donations go to a trust at the 6-month mark until the date of purchase. This donation will again remain in the trust for another 6 months, until the 12-month purchasing period when the employer purchases shares.

Most ESPPs offer a discount of around 15% on the purchase of any company stock. It is quite profitable for you if you can buy something at a 15% discount that you can immediately sell for full market value. Make sure to check your plan document to affirm whether you will receive such a discount. All plans are not the same and some do not offer this ability to buy at a discount.

You pay no tax when you purchase shares of company stock through an ESPP. But you can create a reportable event for tax purposes when you sell those shares. The type of tax that you will pay will depend on how long you held the ESPP shares. The sales of your ESPP shares will also be identified as qualifying or disqualifying nature. A qualifying sale is one that meets the final sale that occurs at least 2 years after the offer date and when the final sale occurs at least 1 year after the purchase date. And anything that does not feet these criteria is a disqualifying nature.

Employee stock purchase plans are generally categorized in two ways:

This type of plan needs the approval of the shareholders before its implementation, and all the participants have equal rights in the plan. The offering period of this type of plan is not greater than three years and there are certain restrictions on the maximum price discount available.

This type of plan doesn’t have as many limitations as a skilled program. Unqualified plans, however, do not have the tax benefits of the after-tax deductions that eligible plans do.

An employee stock purchase plan (ESPP) is a program the is run by any corporation and that allows participating employees…

A Share Repurchase Agreement is a contract between a company and at least one of its investors where the organization…

Asset Allocation is a venture on various investment strategies that intends to adjust chance by partitioning resources among significant classifications,…

A written statement of policy on fraud suggests that the battle against fraud is embraced and sponsored at the highest…

A fraud risk assessment is a type of management that is a device utilized by the board to distinguish and…

A certificate of deposit is a certificate issued by a bank to the individual depositing money at a defined rate…

The investment commitment letters are the engagement between two organizations promising to render financial assistance or pay back the debt…

An equity investment term sheet is where the investor puts resources into an organization by buying portions of that organization…

A return on investment report (ROI) is a financial formula that is used to measure the benefit an investor will…