What is a Template?

In today’s fast-paced digital world, efficiency and consistency are key to content creation, and this is where the power of…

Jan 18, 2020

In any industry, business liability insurance covers almost all the risks a business can presumably suffer. Risks may include a formal lawsuit, cost of legal defense, medical and injury expenses (when someone gets hurt in the company), punitive and compensatory damages, libel, slander, copyright infringement, and other estimated costs or losses. When your business hasn’t been insured yet, then this article is what you need to read and explore. Provided below are the different types of templates and forms that might be of perfect relevance to any insurance-related transaction. You may also see some our document templates.

Are you looking for a unilateral liability release template that you can edit and modify to the advantage of your business? Great! You’ve found the perfect model. This Unilateral Liability Release Template can save your business from further business-related damage or loss. You can download and edit now using Google Docs, MS Word, and Pages!

Get to create a well-detailed business plan if you wish to establish an insurance agency. Make use of this Insurance Agency Business Plan Template to help you draft a project you want. You may personalize and customize it using Google Docs, MS Word, and Pages. What are you waiting for? Download it now!

The Request Immediate Insurance Coverage For New Employee Template will allow you to get the insurance coverage for a new employee, especially when that employee is more exposed to a dangerous and hazardous job position. You can make use of the original content and a layout to satisfy your specific coverage needs. Need a copy of this template? Download it immediately!

The first step to determine a business liability insurance cost is to identify the type of business. The Liability Insurance protects your business from a potential lawsuit, a third-party claim, or financial damage. For this reason, an insurance company needs to classify and identify the type of business you’re running to allocate the coverage it needs. Since there are definite coverages for the different business classifications, determining the manner of your business is a must.

When an insurance company already has an idea about your business, they would suggest a specific insurance coverage according to the perceived risk and the type of your business. The term “insurance coverage” may refer to the cost of risk or liability covered. In general, there are two types of insurance coverage; auto insurance and life insurance. While the first type will depend on your driving record, the latter considers your age. In profit organizations, the insurance coverage will always depend on the type of business you have.

When your business falls into the lower risk category, an insurance company will offer the coverage with a more cost-effective rate or premium. An insurance premium is the amount of money your business has to pay. This aspect will be based on the insurance policy your business falls into. The bigger the risk, the bigger the insurance premium your business must have to pay for the insurance policy.

When the risk is too much for an insurance company to handle, they will probably add a new and necessary policy. They need to ensure that all your financial and legal needs will be covered in the event of the business-related risks. But when there’s nothing much to worry about the possible risk your business will possibly face in the future, then an insurance company won’t add anything to your coverage.

To minimize the cost, you need to avoid any duplication of the coverage. You may do so by eliminating the unnecessary coverage or by including the exclusions clause. Otherwise, your business will suffer significantly by paying a much higher cost.

Plan ahead of time concerning your insurance agency business. With the help of our ready-made Insurance Business Plan Template, you will now be able to lay out the strategies and set out the schedules. Make haste! Never let this rare opportunity slip through your fingers. Download right here and now!

Make sure to draft a legally binding insurance-related notice with the use of this Legal Notice Template. This legal notice template is fully editable and 100% customizable in all versions of MS Word and Apple Pages. If you’re looking for this type of model, then you’re free to secure a copy or two today. What are you still waiting for? Download it right away!

This Notice of Default in Payment Template can be a useful tool for you to draft a document you need to inform your customers regarding their financial obligations. Most insurance companies utilize a notice of default in payment, most especially if they are to let someone know of their financial dues. Download this template and modify the original content using any of our flexible file formats!

A Disclosure Notice Template is a tool used by the realtors and the real estate agents to provide the details a customer needs regarding a real estate business. However, the same template is also used by most insurance company agents to stipulate the coverages and the rates that their customers are asking from them. If you need this disclosure notice template today, you can have a copy now by directly downloading it right away.

If your insurance agency needs a simple organizational chart template, you can make use of our ready-made Free Insurance Agency Organizational Chart Template. All you have to do is modify or change the preformatted details. You can do that in Google Docs, MS Word, or Apple Pages file format. Download the template now to start the editing process!

Use this Free Letter to Property Insurance Company to create a document you need for a property insurance cancellation. This template is print-ready and ready-made. Also, it is made available in A4 & US print sizes, perfect for commercial as well as personal printing. Don’t waste your valuable time. Download it right now for free!

https://cel.sfsu.edu

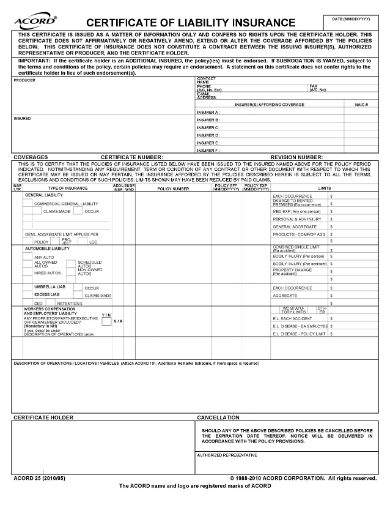

https://cel.sfsu.eduWhen you want your small business to be insured, an insurance company would undoubtedly ask for requirements. And when you have settled all the documents, they would issue a certificate that verifies your insurance coverage. To do that, this Certificate of Liability Insurance Form can be of great help in the process. You can utilize this file in a Portable Document Format (PDF). Secure a copy now!

https://www.kamaoxford.org.uk

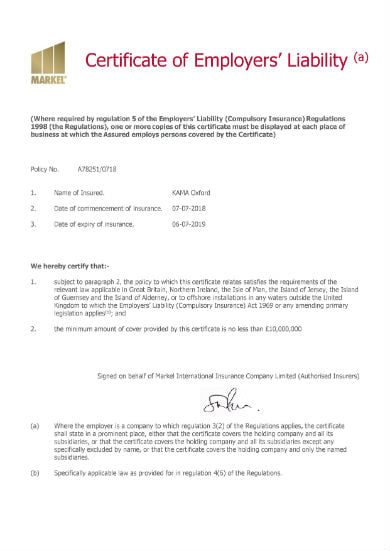

https://www.kamaoxford.org.ukA certificate of employer’s liability or employer’s liability insurance certificate is a document issued by the insurer to attest that your business company has already had such an employer’s liability insurance. To help you draft one, you may download a copy of this Certification of Employers’ Liability Sample Form in a Portable Document Format (PDF) right away.

In today’s fast-paced digital world, efficiency and consistency are key to content creation, and this is where the power of…

hospitality induction hospitality induction program hospitality induction manual hospitality induction training hospitality induction checklist 4+ Hospitality Induction Templates in DOC…

Whether you are a business or an organization, it is important for you to keep track of your business bank…

A Company Description provides meaningful and useful information about itself. The high-level review covers various elements of your small business…

A smartly designed restaurant menu can be a massive leverage to any food business.

Whether you need to keep neat records of received payments, or are looking for a template that helps you look…

The most widely recognized use for a sample letter of planning is the understudy who, after finishing secondary school, wishes…

The term “quotation” can refer to several things. While to some it may refer to a quote, which is proverbial.…

A catering quotation is a document that provides information about the initial price of the package offering of a caterer…