3+ Audit Debrief Templates in PDF | MS Word

The audit debrief is reviewing or recalling of the performances in the financial system and also looking for the areas…

Jul 06, 2020

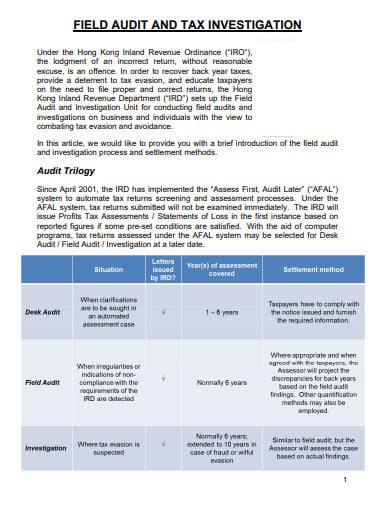

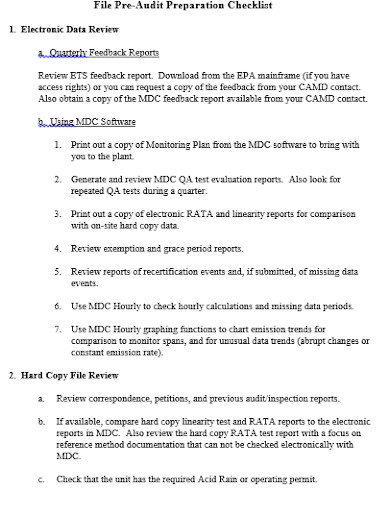

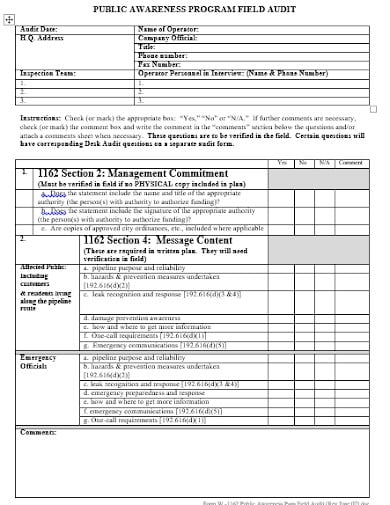

A complete tax audit managed by the Internal Revenue Service (IRS) at either the taxpayer’s home, area of business or accountant’s office, so they can monitor your individual or business financial records to guarantee you filed your tax return correctly is referred to as a field audit. Have a look at the field audit templates provided down below and choose the one that best fits your purpose.

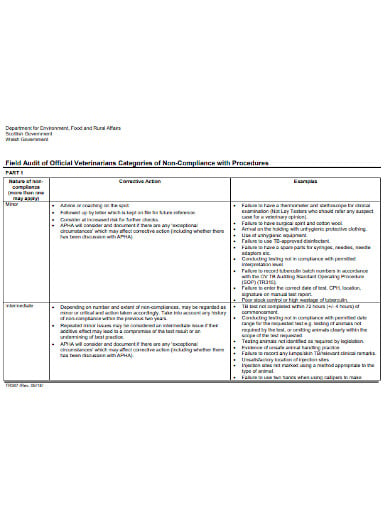

apha.defra.gov

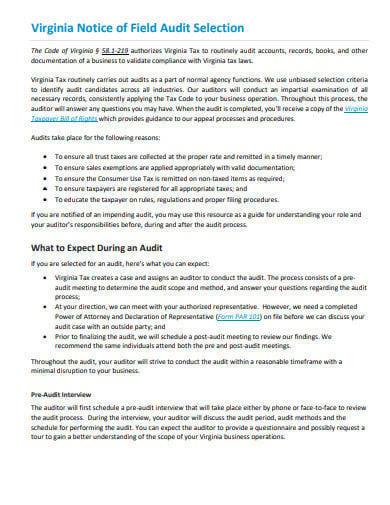

apha.defra.gov virginia.gov

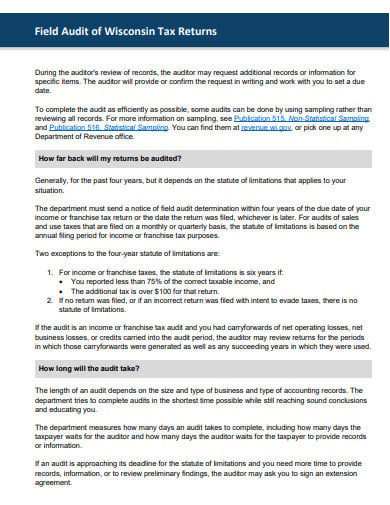

virginia.gov revenue.wi.gov

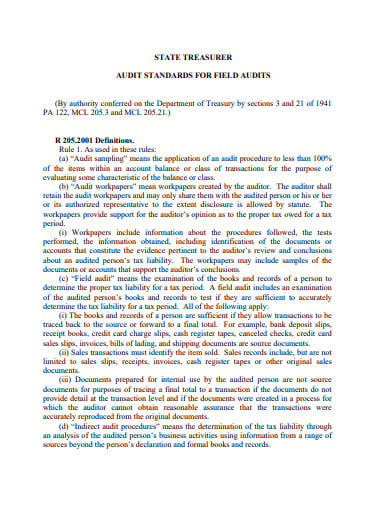

revenue.wi.gov state.mi.us

state.mi.us bessereau.eu

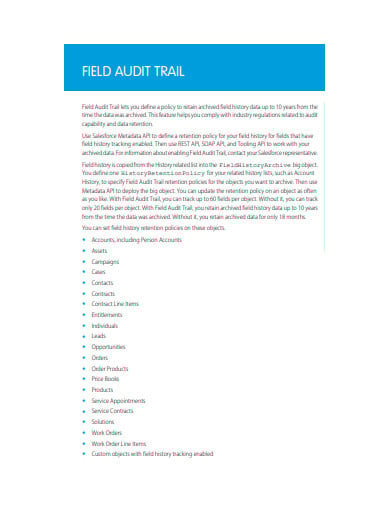

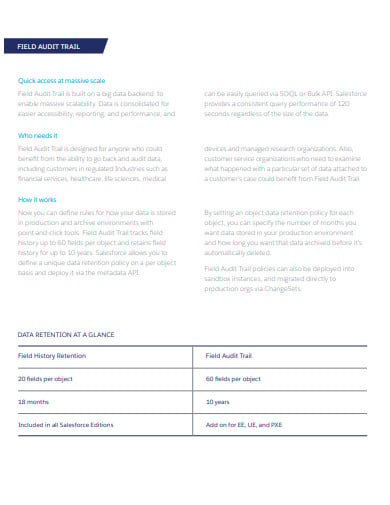

bessereau.eu sfdcstatic.com

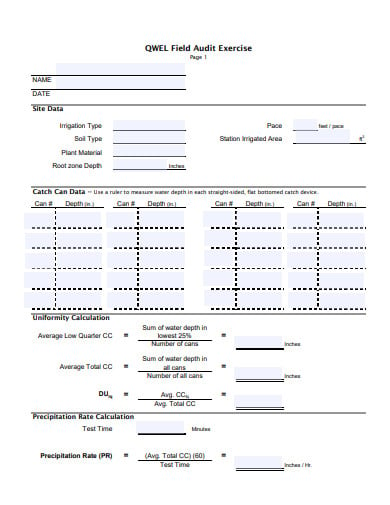

sfdcstatic.com qwel.net

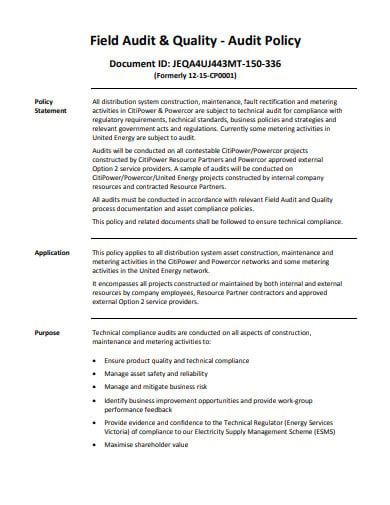

qwel.net powercor.com

powercor.com hic.com

hic.com epa.gov

epa.gov utc.wa.gov

utc.wa.gov

The audit debrief is reviewing or recalling of the performances in the financial system and also looking for the areas…

The audit confirmation includes the balance due by the client or owed to the supplier on the audit client’s balance…

As there is a saying that ” with big positions comes the big responsibilities”. It is the huge duty to…

The audit report is the ending result of an audit and can be utilized by the receiver person or organization…

An audit letters of representation is a kind of letter provided by an organization’s service auditor and confirmed by a…

An audit confirmation letter is a particular type of interrogation or a legal request from an internal or external customer…

Audit committee reports present a periodic and annual picture of the financial reporting method, the audit process, data on the…

Audit Executive Summary is a short section of an audit report. It is the summary that is usually developed for…

The auditor and the client must agree on the terms of the engagement based on the auditing standards and these…